Reuters/London

Emerging market stocks fell to a three-week low yesterday as a buoyant dollar and China calling its lowest growth for 25 years a ‘new normal’ soured the mood among investors.

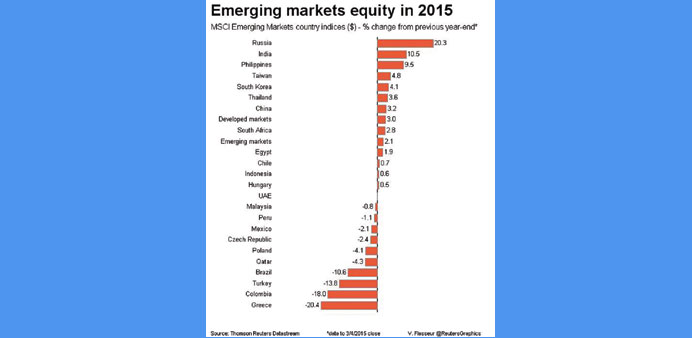

The MSCI emerging equities index was 0.2% lower at a level last seen in mid-February, while the Asia excluding Japan benchmark, fell 0.4%.

A strengthening dollar, driven by anticipation of tighter monetary policy in the US, continues to pressure emerging assets.

The dollar index reached an 11-year high and most emerging currencies weakened.

“There’s a lot of expectations of a Fed rate hike built in. There are exceptions, like the central European countries, but most of the dollar-based currencies are really focusing on the US and the likely pickup in US rates,” said Simon Quijano-Evans, head of emerging research at Commerzbank.

Also adding to pressure on emerging markets is the prospect of an economic slowdown in China after Beijing announced a 7% growth target for the year and signaled that the lowest rate of expansion for a quarter of a century is the “new normal”.

Shanghai stocks traded 1% lower while Hong Kong dropped 1.2%.

Turkey’s lira was 0.9% lower against the dollar as investors remained nervous about threats to central bank independence following tirades against monetary policy by president Tayyip Erdogan.

Shares in Turkey’s Akbank were 5% lower after Citigroup announced it has sold its nearly 10% stake for $1.2bn.

Earlier, the Indonesian rupiah hit a near 17-year low to the dollar while the ringgit slid to six-year lows .

Eastern European bourses were firmer on the prospect of monetary stimulus for eurozone trading partners ahead of a European Central Bank meeting.

Budapest rose 0.7% and Warsaw traded 0.5% higher. Poland on Wednesday cut rates by 50 basis points, twice as much as expected, and signaled its monetary easing cycle had come to an end.

That helped the zloty rise 0.2% to the euro as the currency is now seen holding its yield advantage over the single currency.

The forint rose 0.3%

With oil markets holding above $60 per barrel, Moscow stocks advanced, with the dollar-denominated RTS index up 1.5% while the rouble firmed 0.1% against the dollar.

Belarus’ Finance Minister Vladimir Amarin said yesterday the country plans to issue at least $700mn worth of domestic bonds denominated in foreign currency this year.

In 2014, Belarus placed $800mn worth of bonds on the local market.