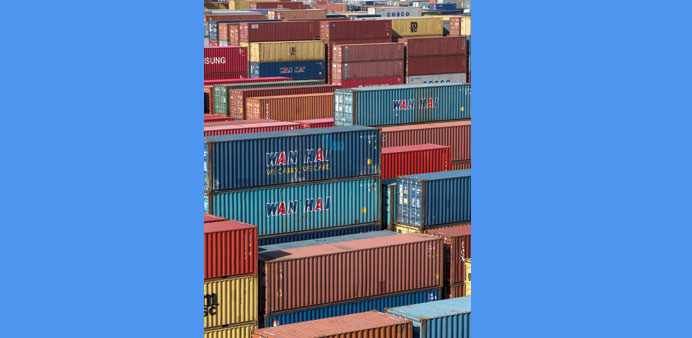

Containers sit stacked at the CJ Korea Express Corp terminal in the Port of Gwangyang. South Korea’s exports in February fell 3.4% from a year earlier to $41.46bn, while imports plummeted 19.6% to $33.80bn, the Ministry of Trade, Industry and Energy said yesterday.

Reuters/Seoul

South Korean exports last month suffered their worst fall in two years on weaker sales to Europe and China, lower oil prices and long holidays, but the government said global demand showed some signs of recovery.

Exports in February fell 3.4% from a year earlier to $41.46bn, while imports plummeted 19.6% to $33.80bn, the Ministry of Trade, Industry and Energy said yesterday. The $7.66bn trade surplus is a record for any month.

Overseas sales saw the steepest annual fall since February 2013 while imports had their biggest decline since October 2009, which the ministry blamed on weak oil prices as Dubai crude prices dropped 53% on-year.

The export decline was “mainly attributable” to fewer working days due to the Lunar New Year and falling prices for oil products and petrochemical products, the ministry said.

The average export value per working day was 9.3% more in February than a year before, while exports excluding oil products and petrochemicals were 0.8% higher than a year earlier.

Exports to the European Union dropped 30.7% from a year ago, the fastest decline since January 2012, while shipments to China slipped 7.7%. Exports to the US rose 7.4%.

South Korea, the world’s seventh-largest exporter and Asia’s fourth-largest economy, is the first major economy to report monthly trade figures.

The February performance was slightly worse expected than expected in a Reuters poll that saw exports falling 1.8% and imports 11.7%.

The three-day Lunar New Year holidays were in late February this year but January last year. Oil products and petrochemicals, highly sensitive to price changes, account for nearly one-fifth of South Korea’s exports.

Distortions in economic indicators during January-February will likely let the Bank of Korea hold policy steady at its March 12 meeting while awaiting global data.

“We will see export growth increasingly diverge between the US and non-US economies amid high volatility in headline numbers,” said Stephen Lee, an economist at Samsung Securities in Seoul, adding the central bank would not change policy in March.

The Bank of Korea (BoK), which cut interest rates twice last year, has held them since October. It and the government see economic growth quickening this year after rising to 3.3% last year from 3.0% in 2013.

China, South Korea’s largest export market, on Saturday cut interest rates. Yesterday, an official survey showed Chinese factory activity contracted for a second month in February.