AFP/Tokyo

Japan’s inflation rate has fallen to its lowest level since Tokyo launched a high-profile offensive aimed at conquering years of falling prices and tepid growth, data showed yesterday.

The disappointing figures – weighed by weak consumer spending and falling energy prices – challenge Bank of Japan chief Haruhiko Kuroda’s claim that inflation is on an uptrend.

They may also aggravate doubts over Tokyo’s wider bid to kickstart the world’s number three economy and reverse years of stagnant or falling prices which were blamed for holding back growth and denting firms’ expansion plans.

Sustained inflation is a key measure of Prime Minister Shinzo Abe’s three-pronged growth plan, dubbed Abenomics, to resuscitate Japan’s long-suffering economy.

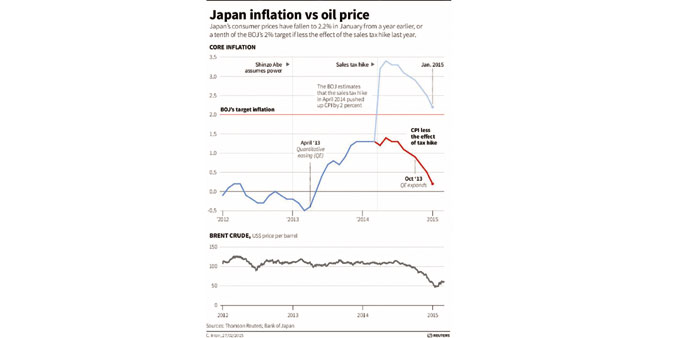

The government data yesterday showed that Japan’s inflation rate last month came in at 2.2%, down from 2.5% in December.

But stripping out the effect of a sales tax hike last year, it rose just 0.2% from a year earlier, the lowest since a zero per cent rate in May 2013, and well short of the Bank of Japan’s much-touted 2.0% inflation goal which it hopes to reach during the fiscal year starting in April 2015.

Prices had been on the rise, largely due to Japan having to import pricey fossil fuels to plug an energy gap left by the shutdown of atomic reactors in the wake of the 2011 Fukushima accident.

But plunging oil prices have dealt another blow to the BoJ’s inflation goals, and doubts are growing over the ambitious target – even among BoJ members.

Minutes from the central bank’s January meeting showed that three of nine policy board members were doubtful about the feasibility of reaching the price target.

Despite insisting that the BoJ was marching toward its inflation goals, Kuroda has also said the BoJ would further expand its unprecedented monetary easing campaign – launched in April 2013 – if necessary.

“Currently, 80% of private-sector economists expect additional easing by the end of the year,” SMBC Nikko Securities said in a note.

“We expect additional easing will come in late April.”

The inflation data were among a mixed bag of figures that also showed a better-than-expected expansion in factory activity, but analysts warned that the uptick was likely to fizzle in the coming months.

Separately, the internal affairs ministry said spending by Japanese households fell a greater-than-expected 5.1% from a year ago, as the sales tax hike to 8% from 5% weighed on shopping nationwide.

The jobless rate last month ticked up to 3.6% from 3.4% in December.

Following the levy rise in April, Japan’s economy fell into recession, prompting Abe to put off a second sales tax hike this year, which was aimed at taming Japan’s enormous national debt.

Japan limped out of recession in the last quarter of 2014, according to earlier data, with a weak 0.6% expansion between October and December.

But over the full year the preliminary data showed zero growth, compared with 1.6% in 2013.

The recovery in factory output has been led by stronger exports, with Japan’s industrial production in January expanding by a better-than-expected 4.0% on-month, the second consecutive month of increase and beating a revised 0.8% rise in December.

Still, the upbeat figure did not warrant much optimism, said Marcel Thieliant from Capital Economics.

“While industrial production surged in January, firms are predicting a renewed decline in coming months as consumer spending remains sluggish,” he said.

Factory output jumps, but consumers unconvinced by BoJ stimulus

Reuters/Tokyo

Japanese households cut spending more than expected and retail sales fell for the first time in seven months in January, data showed yesterday, a sign the central bank’s radical stimulus has yet to convince consumers that inflation will take hold.

In contrast to the gloom felt among households, companies looked to be in better shape as they begin to benefit from the competitive advantage their goods get from a weak yen.

Factory output jumped at the fastest pace in nearly four years in January as companies ramped up spending at home and won more orders in emerging markets, suggesting that exports will keep the economy on track for a moderate recovery.

But the soft consumption readings underscore the unevenness of the recovery and pose a headache for the Bank of Japan, which hopes its aggressive money printing will drive up inflation expectations and prompt households to spend more.

“If consumer spending doesn’t pick up by April, it will be difficult for industrial production to accelerate,” said Shuji Tonouchi, senior fixed income strategist at Mitsubishi UFJ Morgan Stanley Securities.

Separate data underscored the dilemma the central bank faces with inflation almost grinding to a halt on slumping oil prices, moving further away from the BoJ’s ambitious target of reaching 2% around the next fiscal year beginning in April.

BoJ Governor Haruhiko Kuroda defended his two-year timeframe for achieving the target on Friday, warning that adopting a relaxed approach to the deadline would undermine efforts to defeat deflation.

But analysts are deeply sceptical of whether the BoJ can meet its goal, as they expect it to take at least six months for the benefits of lower oil prices to boost growth, assuming consumers will spend the money they save on their fuel bills.

The weak consumer mood has kept a lid on spending as wages have yet to increase enough to make up for the sales tax hike last April, casting doubt on the strength of the recovery.

Household spending fell a more-than-expected annual 5.1% in January in the 10th straight month of declines, the longest losing streak since the global financial crisis in 2009. Annual retail sales dropped a worse-than-expected 2.0%.

In a glimmer of hope, factory output jumped 4.0% in January, exceeding a 2.7% gain expected by economists and the biggest increase since 2011.

“Output is showing signs of an export-led recovery” as solid US demand acts as a driver of global growth, said Hiroshi Watanabe, senior economist at SMBC Nikko Securities.

“This virtuous cycle of factory activity will continue to underpin Japanese output and capital spending ahead.”

Solid US growth is encouraging exporters of electronics and cars, such as Nissan Motor Co, which is trying to boost shipments from Japan to benefit from the weaker yen.

“I can’t (give) you concrete numbers now but we have already started to work on how we can capitalise on the available capacity in Japan for North America,” said Jose Munoz, executive vice president at Nissan and chairman of its North American arm.

For the whole Japanese auto industry, however, sales are steadily falling due partly to April’s sales tax hike.

Manufacturers surveyed by the ministry expect output to rise only slightly in February and fall 3.2% in March, as overseas orders for machinery and electronic parts peak from current very high levels, a ministry official told reporters.

The mixed data will keep the BoJ under pressure to maintain its stimulus, although Governor Haruhiko Kuroda has stressed he saw no need to ease policy again soon.

Stripping away the effect of last year’s tax hike, the core consumer price index – which excludes volatile food but includes oil costs – rose just 0.2% in January year-on-year, less than expected and slowing from 0.5% in December.