Reuters/Berlin

Germany posted its biggest budget surplus since reunification in the first half of 2014, underscoring the strength of its finances at a time it faces growing pressure to loosen the fiscal reins and spend more to bolster growth in Europe.

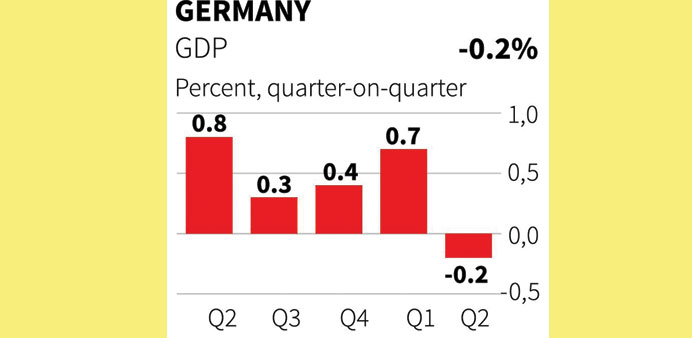

The budget figures came as a detailed breakdown of German gross domestic product (GDP) data showed that a sharp decline in capital investments contributed to a 0.2% contraction in the second quarter, further ammunition for critics who say Germany must do more to boost spending.

“In other European countries the figures will give confirmation to those who expect more fiscal policy impetus from Germany,” said Holger Sandte, an economist at Nordea Bank.

Partners like France and Italy have been urging Germany to allow greater fiscal leeway in Europe and take steps at home — such as cutting taxes and boosting public investment — to jump start the eurozone, which stalled in the second quarter.

Last month, European Central Bank President Mario Draghi appeared to back those calls, breaking with his traditional support of German-led budget consolidation, and stressing the need for greater fiscal stimulus. German Finance Minister Wolfgang Schaeuble has played down Draghi’s remarks as “overinterpreted” and German weekly Der Spiegel reported at the weekend that both he and Chancellor Angela Merkel had called Draghi to complain about the speech, though a government spokesman denied the chancellor had done so.

Yesterday, Merkel left the door open to channelling the budget surplus into investment programmes, but said this could only happen if the economy fared well in the coming months. Some economists believe Germany could suffer another quarter of contraction in July-September, technically putting it in recession.

In addition to weak investment spending, the economy is suffering from weak eurozone demand for German exports, sinking business confidence in the face of the Ukraine crisis and worries about the impact of Merkel’s shift out of nuclear power.

Data showed on Monday that Germany’s overall budget surplus — grouping federal, state and local governments and the social security system — amounted to €16.1bn or 1.1% of GDP in the first half the year.

That puts Germany on track to a achieve a surplus in 2014 for a third straight year. It is the only eurozone state expected to achieve a surplus this year, according to forecasts from the European Commission.

“The budget figures reflect the good domestic economy and the rise in employment and consumption,” Nordea’s Sandte said.

In his late-August speech at a central bankers’ conference in Jackson Hole, Draghi said it would be “helpful for the overall stance of policy” if fiscal policy could play a greater role alongside the ECB’s monetary policy. His suggestions included implementing an EU-wide public investment programme.

Some economists believe Germany is suffering from an investment crisis that will take the shine off an economy held up as a model of dynamism during the eurozone’s debt crisis.

Total annual investment levels in Germany amount to around 17% of GDP — below those of other industrialised countries, which average over 21%.

The detailed breakdown of GDP data showed gross capital investment in Germany slid by 2.3% and construction investment fell 4.2%. This drop was partly due to a mild winter which boosted building activity in the first quarter.

Foreign trade, traditionally the driver of German growth, subtracted 0.2 percentage points from growth while private consumption and inventories made a positive contribution.

Other data also pointed to a slowdown. Germany’s manufacturing sector expanded at its slowest rate in 11 months in August and figures from the VDMA engineering association showed orders stagnated in July as demand at home dropped.