Qatar’s real estate market appears to be overheating but the current upward rally is well supported by the country’s strong macro fundamentals, according to QNB.

“Qatar’s fast growing economy and rapid population growth seem to justify a rapid increase in real estate prices, which remains in line with other nominal developments in the economy,” QNB said in a report.

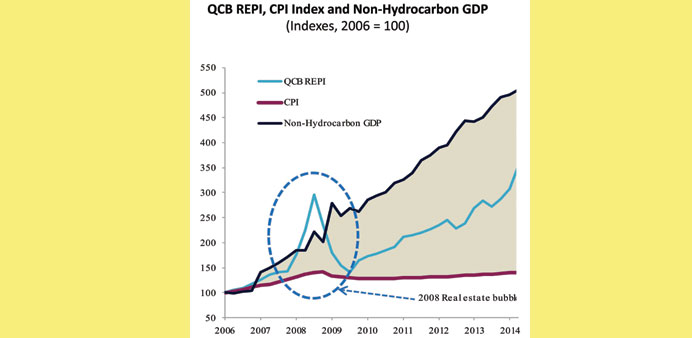

The country’s real estate prices continue to reach record highs, it said, quoting the Qatar Central Bank’s (QCB) Real Estate Price Index (REPI), which shows average prices for land, commercial and residential properties in June 2014 stood 20% above their peak in September 2008.

“This could suggest a potential overheating of the real estate sector,” it said, adding a closer analysis indicates that the increase is “still within the fundamentals of Qatar’s fast growing economy and rapid population growth.”

According to the latest data, the REPI increased 21.5% in the first six months of 2014, showing a significant acceleration compared with the 6.2% increase in the second half of 2013.

First, real estate prices in Qatar have recently been pushed up by both a base effect (population) and an income effect (income per capita), the report said, adding the base effect is the large increase in population experienced since mid-2012.

As population grows, the demand for housing increases, pushing up realty prices and the income effect arises from the higher GDP (gross domestic product) per capita as a result of the rapid economic growth over the last few years. As per capita GDP rises, more income will be spent on housing, pushing up the value of real estate properties.

“Based on this analysis, Qatar’s real estate prices continue to be in line with fundamentals, albeit close to their limits,” it said, adding that while the base and income effect combined have increased by 345% since 2006, the QCB REPI has only risen by 326%, suggesting that real estate prices continue to be justified by Qatar’s economic fundamentals.

“Real estate prices, however, are reaching what may be an upper limit based on this analysis, suggesting possible overheating,” it said.

QNB said real estate prices should not normally outpace the nominal expansion of the domestic economy as this would indicate a real estate bubble.In this context, the growth of non-hydrocarbon GDP is a good proxy for the expansion of the domestic economy and represents an upper bound for real estate prices, it added.

At the same time, real estate prices would normally rise faster than the overall Consumer Price Index (CPI) as the supply of real estate is limited to the domestic market (land and houses cannot be imported) and can only increase with a lag, compared with the price of traded goods (e.g., clothing, food, etc.), which is determined by global demand and supply. The CPI index therefore normally represents a lower bound for real estate prices.

Terming that Qatar’s real estate prices remain well within fundamentals, it said non-hydrocarbon GDP is estimated to have increased by over 500% since 2006, compared with 326% for the QCB REPI and 141% for the CPI.