Reuters

The European Central Bank is unlikely to take new policy action next week unless August inflation figures, due tomorrow, show the euro zone sinking significantly towards deflation, ECB sources said.

Speculation has grown since ECB President Mario Draghi struck a dovish tone at the Jackson Hole central bankers’ meeting last week that the ECB could be moving closer to quantitative easing (QE) — or printing money to buy assets.

Departing from his original speech text, Draghi noted in his Jackson Hole last Friday that “financial markets have indicated that inflation expectations exhibited significant declines at all horizons” in August.

The new inflation data, together with updated projections from ECB staff, are likely to lead to a lively discussion at the September 4 policy meeting about whether to accelerate existing policy measures. New action is unlikely but not impossible.

“The barrier to QE is still very high,” said one of the sources, all of whom requested anonymity, adding that discussion at the meeting was expected to centre on reinforcing existing policy measures of credit easing and liquidity provision.

“It’s hard to say now that nothing will happen. It depends to some extent on the data,” the source added.

The ECB declined to comment.

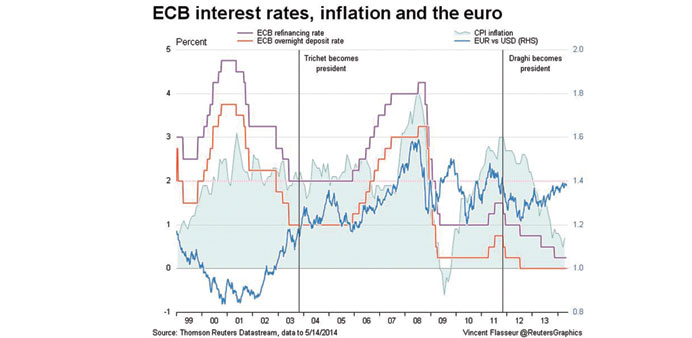

A second ECB source said there was scope to shave another 10-15 basis points off the main refinancing rate if necessary.

The ECB cut the refinancing rate to a record low of 0.15% in June, after which Draghi said “for all the practical purposes, we have reached the lower bound.”

However, in his Jackson Hole speech, he said the Governing Council would acknowledge changes in inflation expectations “and within its mandate will use all the available instruments needed to ensure price stability over the medium term.”

The phrase ‘all the available instruments’ would appear to encompass interest rates.

Keeping up pressure on the ECB, French Prime Minister Manuel Valls said yesterday the euro was still overvalued and that the ECB needed to do more to tackle excessively low inflation.

The August eurozone inflation figures are expected to show a slowdown in the annual rate to 0.3% from 0.4% in July, according to a Reuters poll.

The ECB targets inflation of just below 2% over the medium term. It considers anything below 1% to be in its “danger zone”.

In June, the ECB cut interest rates to new lows and unveiled a four-year funding plan for banks — so-called TLTROs — the first tranche of which goes on offer on September 18. It also said it would develop a plan to buy asset-backed securities (ABS).

However, it may not be practical to change the TLTRO operation so close to its launch. Banks have until Thursday to submit lending reports to the ECB to determine how much they can borrow in September and December under the TLTRO programme.

The new measures are aimed at supporting the flow of credit to businesses in the eurozone to help revive growth. In the second quarter, eurozone economic growth ground to a halt as Germany’s economy shrank and France’s stagnated.

Deploying QE could put downward pressure on the euro and boost market confidence. However, some ECB policymakers believe QE is inappropriate and are not sure it would work.

Hawkish ECB policymakers are particularly resistant to the idea. ECB Executive Board member Sabine Lautenschlaeger, a former member of Germany’s Bundesbank, said last month it needed a “real emergency” for a broad asset-buying plan to be employed.

The second ECB source noted that Draghi’s Jackson Hole speech had helped lower the euro, which fell broadly on Wednesday and hit a 19-month low against the Swiss franc.

“If we get the euro under $1.30, that helps a lot,” this source said. “We need a weaker euro for a stronger Europe.”