Reuters

The battle over Brazil’s telecoms market is heating up, with the country’s biggest fixed-line firm Oi signalling it may make an offer for Telecom Italia’s local mobile business.

The move throws a potential wrench into the bidding war for Vivendi’s Brazilian broadband unit GVT, which both Telecom Italia and Spain’s Telefonica are pursuing to bolster their mobile businesses in the country – number two Tim Brasil and number one Vivo respectively.

Brazil’s leading telecoms groups are jostling for position as they seek to increase their customer bases and gain ownership of high-speed fixed networks. With mobile growth slowing, the companies want to add more services such as pay-TV and broadband to attract customers.

Oi wants to spur consolidation in mobile, which would reduce the number of operators from four to three and potentially take some of the heat out of the competition - a pattern seen in markets such as Austria, Germany and Ireland.

However, it is saddled with around 46bn Brazilian reais ($20bn) in debt after its merger with Portugal Telecom, leading some analysts to question whether it could afford to bid for Telecom Italia’s Tim Brasil on its own.

Oi said in a regulatory filing late Tuesday it had appointed investment bank BTG Pactual to act as its agent or “commissioner” to review options to purchase Telecom Italia’s shares in Tim Brasil on its behalf.

It is setting up what is known as a mercantile commission, or special situations vehicle, which analysts said have been used in the past in Brazil to organise break-ups of companies among multiple buyers.

An investor following the situation said the move only made sense if Oi planned to team up with others on a bid and break-up of Tim Brasil.

“It’s a statement of intent,” said the person, adding that it remained unclear who else would take part. Mexico’s America Movil could be one option given its ownership of Claro, the number three mobile firm in Brazil, the person said.

A three-way takeover of Tim Brasil between Telefonica, Oi and America Movil had been floated late last year by Telefonica and discussed between the companies this year, people familiar with the matter previously told Reuters.

Javier Mielgo, a telecom analyst at Mirabaud Asset Management in Madrid, said a shake-up of Brazil’s telecom landscape lay ahead if GVT or Tim Brasil lost independence.

“A consolidation process has started which offers different scenarios,” he said.

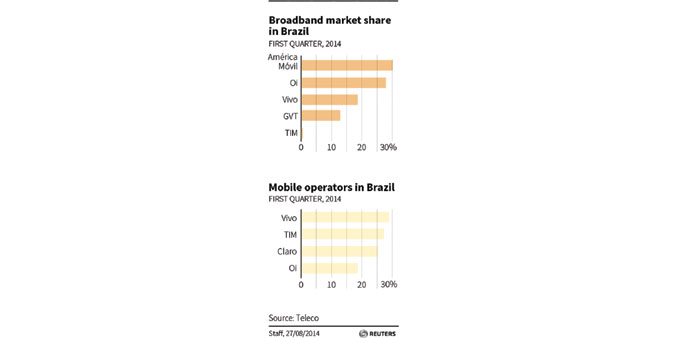

The current mobile pecking order has Telefonica with 28.7% market share at the end of the first quarter, Telecom Italia’s Tim with 27%, America Movil 25.1%, and Oi with 18.5%.

In broadband, America Movil held 30% of the market, Oi 27.7%, Telefonica 18.4%, and takeover target GVT had 12.7%. Telecom Italia’s lack of a fixed network has left it with less than one% share.

A Telecom Italia spokesman declined to comment on whether its board would discuss Oi’s interest in Tim Brasil at a meeting.

The board is expected to vote to finalise Telecom Italia’s offer for Vivendi’s GVT, which sources told Reuters would value the company at roughly 7bn euros and leave Vivendi with a 15 to 20% stake in the Italian group.

Meanwhile, Telefonica’s board was also set to meet on Wednesday to discuss improving its bid for GVT, as it seeks to head off Telecom Italia, said a person familiar with the matter.

“It will be higher than (Telefonica’s original) 6.7bn euros, but it won’t be as much as 8bn euros,” the source said, referring to a figure cited in newspaper reports.

Telefonica’s original bid for GVT, which was submitted to Vivendi in early August, included around 4bn euros in cash plus a 12% stake in the newly combined group.

Telefonica declined comment.