Reuters

Russian shares posted their biggest jump in a month yesterday as investors were relieved that new sanctions announced by Brussels and Washington on Tuesday were as expected and not tougher.

Argentina’s debt insurance costs fell from recent elevated levels and the country’s dollar discount bond rose as investors took some cheer over talks between the country’s officials and holdout debt investors that could avert default.

New EU sanctions on Russia, the full text of which will be made publicly available today, are expected to restrict Russian state-owned banks’ access to medium and long-term financing.

The US added three state-owned banks to its sanctions list – VTB, Russian Agricultural Bank and Bank of Moscow.

“Sanctions had been signalled so much in advance that they were mostly expected,” said Richard Segal, an analyst at Jefferies, adding that sanctions were not as harsh as some had feared.

“There had still been concern that non-financial companies might be targeted.”

The rouble-denominated MICEX index rose 2.3% by 1055 GMT, while the rouble itself was up 0.5%.

Russia’s five-year credit default swaps retraced some recent gains, falling four basis points from Tuesday’s close to 227, according to Markit.

Central European currencies, which have been hit by worries about a regional impact from the sanctions, were little changed.

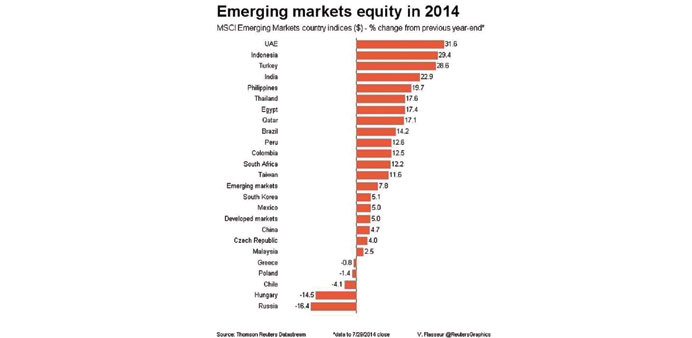

The broader MSCI emerging stocks index rose 0.2% to its highest since early 2012, testing three-year highs, as investors awaited US GDP data and non-farm jobs figures that come out later in the week, while a two-day Federal Reserve meeting ends on Wednesday.

Analysts expect US interest rates to remain unchanged, driving demand for higher-yielding emerging-market assets.