Reuters

Spain registered its fastest economic growth since before the financial crisis in the second quarter, becoming one of the brightest spot in a struggling eurozone, though a sharp fall in consumer prices showed the economy faced risks.

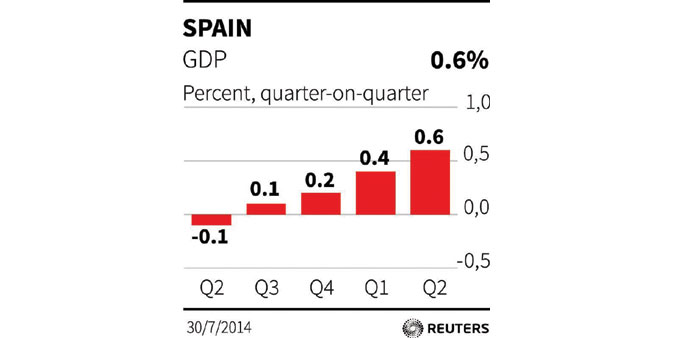

Yesterday’s preliminary National Statistics Institute (INE) reading of 0.6% was the strongest quarter on quarter rise since the final months of 2007 and beat economists’ forecasts of 0.5%. It compared growth of 0.4% in the previous three months.

The institute said internal demand had picked up, but inflation data it released for July — which showed EU-harmonised consumer prices down 0.3% year-on-year — suggested domestic activity may have been less expansive since.

Spain’s Economy Minister Luis de Guindos said on Tuesday the government planned to raise its 2014 and 2015 economic projections in September after stronger-than-expected performance over the last six months.

The forecasts are likely to be raised to 1.5% expansion this year, up from a previous estimate of 1.2%, and 2% next year, up from 1.8%.

On an annual basis the economy grew by 1.2% in the second quarter, INE said — the fastest rate since the second quarter of 2008, up from 0.5% in the previous quarter, and beating economists’ expectations of 1.1%.

This contrasts with Germany and France, the eurozone’s two biggest economies, which are eyeing little or no growth this quarter.

But Spain still faces major economic challenges with unemployment at around 25% and a public deficit of more than 6% of GDP. “There are still a number of post-crisis headwinds facing the Spanish economy,” said Timo del Carpio, European Economist at RBC Capital Markets, in a note.

“But the acceleration in activity seen over the second quarter reaffirms our view that the headwinds on the recovery are continuing to recede. Moreover, we think this out-turn puts the Spanish economy well on course to outperform both Germany and the euro area average over the second quarter of the year.”

Meanwhile, inflation data looks to be going the opposite way, with Spain dropping into deflation — July’s fall in the CPI index was steeper than expected — while prices in Germany continue to rise, albeit modestly.

The Spanish inflation reading was to be followed later yesterday by corresponding numbers for the biggest economy in the eurozone, where the European Central Bank launched broad measures last month to spur growth and avert deflation risks.

German inflation due at 1200 GMT is expected at 0.2% month-on-month and 0.8% year-on-year.

Spanish deflation was greater than the 0.1% drop forecast by analysts and followed a revised 0.1% rise in prices in June. It was the second month recently in which inflation was negative, after prices fell in March.

“This drop can be explained, mainly, by the stability of gasoline, food and non-alcoholic beverages prices following increases in 2013,” INE said in a statement. “The drop in electricity prices has also influenced this trend.”

With private consumption and business investment recovering in recent months their role as engines of the Spanish economy, prices moderation is likely to help consumer spending become more resilient over time.

Internal demand, which accounts for about two third of Spain’s economic output, could also benefit from improving funding conditions as evidenced yesterday by encouraging earnings at BBVA and Popular.