Reuters

Job availability in Japan hit its highest in 22 years in June as companies grew more confident about hiring, and household spending rebounded modestly – reinforcing expectations economic recovery will resume in the third quarter without the need for additional stimulus from the central bank.

The jobs-to-applicants ratio rose to 1.10 in June from 1.09 in the previous month, data from the labour ministry showed yesterday, matching a high last seen in June 1992, shortly after the asset-inflation bubble burst, leading to years of stagnation.

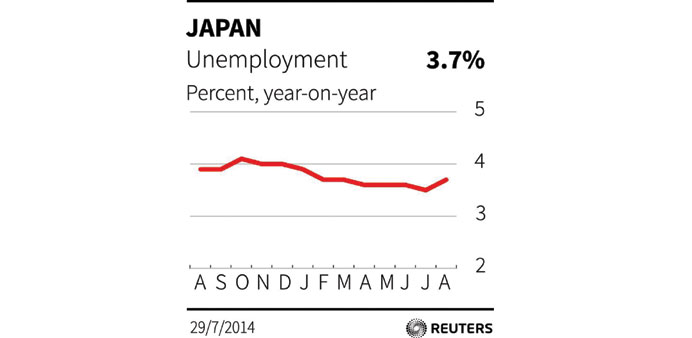

The jobless rate unexpectedly rose to 3.7% in June from 3.5% in May, reflecting an increase in job-seekers responding to economic recovery. Labour shortages in construction and retail suggest the jobless rate is not likely to rise sharply.

A Bank of Japan policymaker said the impact of April’s sales tax hike was likely to be receding gradually, although he warned of the uncertainty of exports as they lacked momentum due in part to the shift of factories abroad by Japanese companies.

“In order for household spending to stay firm, what’s most important is that there is a heightening expectation that incomes will rise ahead,” BoJ board member Koji Ishida said in a speech to business leaders in Shimonoseki, western Japan.

“If job markets continue to tighten, that will support household spending as people feel more job security and heighten hopes that wages will rise,” Ishida added.

Household spending and retail sales data showed signs that consumption is gradually recovering after the sales tax hike, supporting the BoJ’s argument that domestic demand is strong enough to sustain growth and achieve its 2% inflation goal.

“On the whole, we can say that consumer spending continues to recover,” said Hidenobu Tokuda, senior economist at Mizuho Research Institute. “Demand for workers should remain strong as there are labour shortages. Things are moving within expectations. There’s no need for a policy response from the BoJ.”

Household spending rose 1.5% in June from May in seasonally adjusted terms, falling short of economists’ median estimate of a 2.2% increase, but still reversing the contractions seen in April and May.

May household spending fell 3.1% from April when spending tumbled 13.3% as the sales tax hike went into effect.

On an annual basis, Japanese household spending fell 3% in June from a year ago, less than the median market forecast for a 3.8% annual decline, and well below the 8% decline in the year to June.

Retail sales fell 0.6% in June from a year ago, slightly more than the median estimate for a 0.5% annual decline and faster than a 0.4% decline in the year to May. The pace of decline was slower compared with 1997 when the sales tax was last raised, the trade ministry said.

Officials attributed the retail decline in June to bad weather and lingering effects of the tax hike in some sectors, including household appliances.

On a seasonally-adjusted basis, retail sales rose 0.4% in June from May, up for a second straight month, a sign that the sting of the tax hike is easing.

The government raised the national sales tax to 8% from 5% on April 1 to meet rising welfare costs.

A Reuters poll of analysts taken in July found they expected the economy to show a quarterly contraction of 1.4% in the second quarter after the sales tax hike.