By Neal Kimberley

London

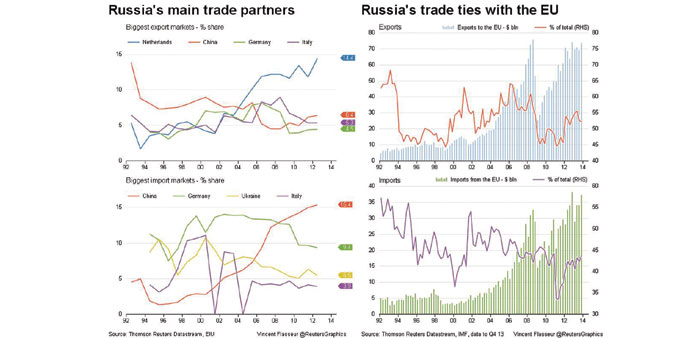

The euro has more room to fall versus the dollar – wider European Union sanctions on Russia related to events in Ukraine will not just affect the Russian economy.

Trade, banking and energy links mean sanctions on Russia, on which European Union members are expected to decide on Tuesday, would also cause pain in the eurozone and take a toll on the single currency.

Germany, the currency bloc’s economic engine, is already feeling the pinch.

Russia may only have been Germany’s 11th most important trade partner in 2013, but those exports had already fallen 14% in the first four months of this year. That drop was already putting 25,000 jobs at stake, according to one business lobby group.

And that was before the downing of a Malaysian airliner over Ukraine on July 17 prompted the EU to consider new sanctions.

Widened EU sanctions may curb both actual activity and business confidence in a German economy that has already shown signs of slowing.

That could translate into further weakness for the euro. The single currency is already trading around eight-month lows against the dollar as the US economic recovery outpaces the euro zone’s and the monetary policy outlooks of the Federal Reserve and European Central Bank diverge. Part of the fall in the Munich-based Ifo think tank’s business climate index, released on Friday after a survey conducted between July 4 and 24, was attributed to geopolitical concerns.

European banks have sizeable exposure to Russia, so they could suffer collateral damage from sanctions. Overseas banks had $242bn of loans to Russia at the end of September 2013, according to data from the Bank for International Settlements. European banks accounted for $184bn or 76% of that total, so the stakes are high.

Any suggestion that deterioration in relations will affect energy supplies from Russia to the EU should mean the euro will fall even faster against the dollar. The US has much less to lose in terms of trade relations. And it enjoys the security of cheap shale oil and gas.

It is also likely that the US expects its European allies to act, regardless of the economic cost.

The US State Department will not have forgotten that what was then the European Economic Community failed to match US sanctions against the Soviet Union after the declaration of martial law in Poland on Dec 13, 1981.

On July 21, UK finance minister George Osborne said Britain was prepared to take an economic hit from imposing further sanctions against Russia because the costs of not acting would be greater.

His German counterpart, Wolfgang Schaeuble, took a similar view at the weekend. He was quoted in the Bild am Sonntag newspaper as saying Germans must put peace before economic considerations and accept tougher sanctions if necessary.

Neal Kimberley is a market analyst for Reuters. The opinions expressed are his own.