US companies are reporting sluggish financial results in Latin America, showing the risks they face in relying on Brazil and other emerging markets in the region for growth.

Companies ranging from Ford Motor Co to 3M Co and Caterpillar reported second quarter earnings that highlighted weakness in their Latin or South American operations.

While Venezuela’s weak currency valuation previously weighed on US corporate finances, the latest results indicate broader struggles. Several companies reported tepid performance in Brazil, the biggest economy in Latin America, where some economists fear the country is on the verge of a recession.

“The place where we see a little bit more of a challenge is Latin America,” 3M Chief Executive Officer Inge Thulin told analysts on the company’s quarterly conference call on Thursday. The diversified manufacturer, whose products include office supplies and industrial adhesives, cut its full-year revenue forecast for the region, the worst-performing in the quarter, hurt by a sales decline in Brazil.

US companies that have looked to emerging Latin American economies for growth have seen those expectations dented in recent months by Brazil’s political and economic turmoil, Venezuela’s currency woes and Argentina’s renewed battle with major creditors.

“This is kind of the up-and-down of emerging markets,” said J. Bryant Evans, who manages an international equity income portfolio at Cozad Asset Management in Champaign, Illinois.

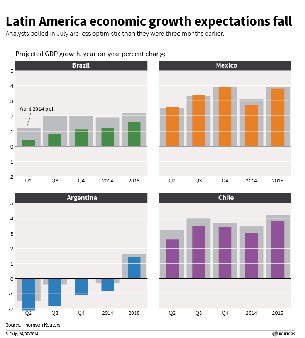

A poll of more than 60 economists from earlier this month found that Latin American economies will probably grow at a slower pace than previously thought this year. Economies in Brazil, Argentina and Chile are expected to be weaker this year than in 2013, while Mexico is far from achieving the fast growth promised by sweeping economic reforms, the poll found.

US corporate prospects in Latin America have also been dampened by competition, lack of expected growth among the middle class and fluctuations in commodity prices, said Rafael Amiel, director for Latin America economics at research firm IHS.

“For multinational companies, the growth they were expecting in many Latin American markets is not happening,” Amiel said.

South America was the only region in the world where Ford posted a quarterly loss - $295mn, compared with a $151mn profit a year earlier.

South American countries “remain largely closed markets that have trade barriers up across many sectors of their economies, so they are actually pretty uncompetitive on a global basis, and that includes the automotive industry,” Ford Chief Financial Officer Bob Shanks told Reuters. “Now that that capital is flowing out, those economies are suffering.”

The importance of the Brazilian market to US companies has been rising over the past few years. Though South America has held steady at about 1.6% of sales at S&P 500 companies over the past three years, Brazil’s portion of sales within the region more than doubled between the start of 2010 and 2014, according to Thomson Reuters data.

Earlier this week, the Brazilian government lowered its economic growth forecast for 2014 to 1.8% from 2.5%. Economists think the growth could be even more tepid - 0.97%, according to a weekly survey.

Caterpillar, which reported a 16% decline in second quarter Latin American sales, lowered its overall sales outlook in part because of worries over Brazil, Chief Financial Officer Brad Halverson told Reuters in an interview.

“We are concerned about Brazil,” Halverson said. “They raised interest rates last year. The economy is slowing. Consumer confidence is plunging along with business confidence.”

Whirlpool Corp reported a lower operating profit in Latin America and downgraded its forecast for appliance market sales in the region for 2014. Still, company executives said weakness in Brazil was more of a short-term concern and expressed optimism about the economy.

“We continue to believe that the macroeconomic indicators in Brazil point to long-term healthy demand growth,” Mike Rodman, president of Whirlpool International, told analysts.

Some cracks also emerged in Mexico, the region’s second-largest economy. For example, a new tax in Mexico has put pressure on US food companies such as PepsiCo, which blamed the tax for sales declines in its food business.

While companies such as 3M reported solid results from the country, the Mexican economy grew by only 0.3% in the first quarter. John Gerspach, the chief financial officer of Citigroup, which has about $11.7bn of credit card loans in Latin America, told analysts last week that “as the Mexico economy continues to struggle to really regain the momentum that everyone thought that it would have, consumer spending has not been robust.”