By Una Galani/Hong Kong

Saudi Arabia’s opening will finally put the Middle East on the investor map. Foreigners will be allowed direct access to the kingdom’s $530bn stock market from next year under reforms announced on July 22. It gives investors good reason to pay attention to the region beyond oil and war. For an emerging market, Saudi Arabia is well regulated, growing fast, and is more stable than most.

Foreigners have been able to buy into Saudi since 2008 through swap agreements, but these are expensive and lack the voting rights that would come from owning shares outright. As such, foreign participation in the market has languished below 5%. What happens next may look like China’s domestic stock market, which grants licences to “qualified foreign institutional investors”, subject to an investment ceiling. It would also allow Saudi to limit foreign investment in sensitive areas, like real estate in the holy cities of Mecca and Medina.

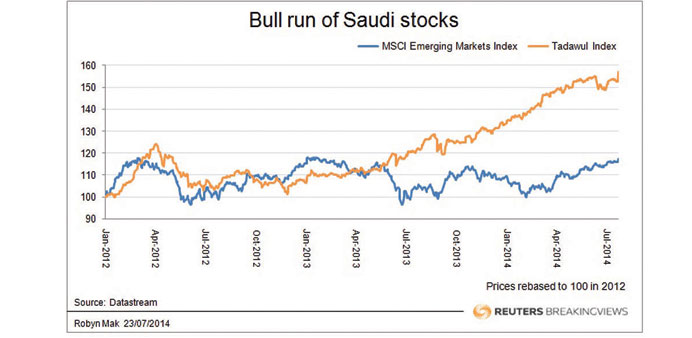

Saudi easily outshines the stock markets in Middle East already afforded emerging market status by influential index compiler MSCI. It is bigger by market capitalisation than Egypt, Qatar and the United Arab Emirates combined. Although recent scandals have dragged down the region’s reputation for corporate governance, Saudi’s capital market regulator is regarded as the best of the bunch.

Yet investors eyeing Saudi’s diversified blue-chip companies like Saudi Basic Industries Corp (Sabic), one of the world’s largest petrochemical companies, Saudi Telecom, and food groups Savola and Almarai, will have to contend with remarkable volatility. At 17 times price to earnings for this year, the benchmark Tadawul index is also more expensive than global peers such as Brazil, China, India and Russia.

Despite the risks, Saudi’s big draw is its stability. The country’s rulers were rattled by the Arab spring even though there was never any real chance that they would be toppled like their neighbours. Still, the King Abdullah pledged $130bn of extra spending to limit the contagion — which has, in turn, helped to boost share prices. With GDP growth at 4%, a dividend yield of 3%, and no sign that oil prices will fall any time soon, Saudi’s opening looks compelling.

CONTEXT NEWS

- Saudi Arabia plans to open up to direct investment by foreign financial institutions in the first half of 2015, the market regulator said on July 22.

- “The market will be open to eligible foreign financial institutions to invest in listed shares during the first half of 2015, with God’s permission,” the Capital Market Authority (CMA) said in a statement after the country’s cabinet gave the green light for the move.

- The CMA said it would publish draft regulations for the reform next month and then hold a 90-day consultation period. Index compiler MSCI said it will consult with investors about adding Saudi Arabia to its broader stock indices and could place it on review for classification as an emerging market in June 2015.

- If Saudi Arabia only partially opens up in the same way as the Chinese domestic “A” share market, which sets a quota for foreign investors, it would likely be a standalone index, MSCI executive director Sebastien Lieblich said.

- Foreigner investors outside of the neighbouring Gulf countries can currently only invest in the Saudi stock market using swap agreements through local authorised brokers. They make up less than 5% of the market and around 2% of turnover.

- The Saudi benchmark Tadawul index rose 2.8% on July 22 following the announcement by the CMA.

- Reuters: Saudi Arabia prepares to open $530bn bourse to foreigners.

• The author is a Reuters columnist. The opinions

expressed are her own.