Reuters/London

British retail sales rose between April and June at the fastest pace for a calendar quarter in 10 years despite stagnating last month, bolstering expectations that the economy has sustained its swift pace of recovery.

Retail sales volumes rose 1.6% in the second quarter compared with the previous three months, a latest sign of strength in Britain’s economy which has put a first interest rate hike on the agenda of the Bank of England.

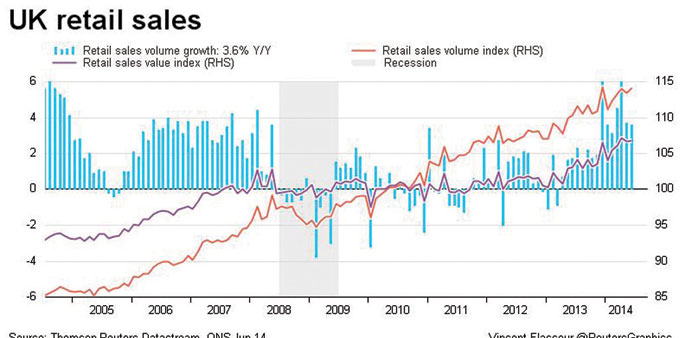

Still, retail sales growth for June alone disappointed, rising just 0.1% from May and by 3.6% compared with a year ago, according to the Office for National Statistics.

That was weaker than Reuters poll forecasts for increases of 0.3% and 3.9%.

The ONS said a fall in clothing sales during the month was probably the result of delayed price-cutting on summer clothes by retailers who normally hold sales in June but may have held off this year due to good weather.

With retail sales accounting for just under 6% of British economic output, economists said the quarterly figure boded well for a first reading of Britain’s gross domestic product in the April-June period, which is due today.

“The meagre growth in the official measure of UK retail sales volumes in June probably understates the underlying strength of the consumer recovery,” said Samuel Tombs, senior UK economist at Capital Economics.

Tombs said the soccer World Cup was likely to have distracted many consumers from shopping last month and the previous six World Cup years have shown sales usually pick up again in July.

Sterling fell to a four-week low against the dollar following the weaker-than-expected monthly figures.

Britain’s consumers have been the main driver of the country’s economic recovery which began last year. Low levels of inflation – despite a surprise surge last month – has eased the pressure on their spending power.

Wage growth, however, remains very weak.

Economists expect today’s GDP numbers to show the economy grew 0.8% from April through June, the same pace of growth as in the first quarter.

There is a risk that growth could be slower than that after industrial output figures were weaker than expected in May and as wage growth continues to lag inflation - a crucial issue for the Bank of England as it gauges when to raise interest rates.

Some business surveys and housing market reports over the last month have given tentative signs that the strong pace of economic growth might cool in the second half of the year.