By Pratap John/Chief Business Reporter

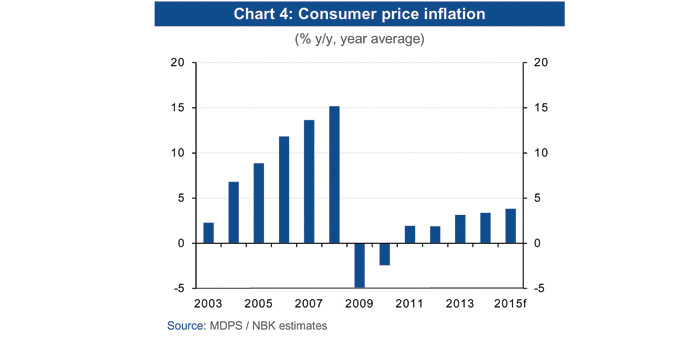

Qatar’s inflation is firming up largely due to rising rents and higher costs in transportation and communication, National Bank of Kuwait (NBK) has said in a report.

Headline inflation increased by 3.4% year-on-year (y-o-y) in May, due largely to rising rental prices and costs in the transportation and communications categories, it said.

Rents, which comprise 32% of Qatar’s CPI basket, have been rising — by almost 7% y-o-y in May — due to tight conditions in the residential market.

Limited residential housing and burgeoning expatriate inflows — Qatar’s population grew by 10.7% y-o-y in May — are the main reasons, NBK said.

Also, an increase in retail diesel prices by 50% helped push inflation in the transportation sector to 2.6% y-o-y. Overall, headline inflation is forecast to increase by 3.4% y-o-y and 3.8% y-o-y on average in 2014 and 2015, respectively.

Qatar’s index of real estate prices, meanwhile, which is published by the central bank, also shows the value of real estate transactions including properties and land rising, by 16.3% y-o-y as of March.

On “primary challenges” facing Qatar, NBK said in its latest economic update that the country needs to tackle “sensitivity to hydrocarbon prices and inflation”.

Sensitivity to hydrocarbon prices remains the central risk facing oil and gas exporters in the GCC. While the threat of hydrocarbon supply disruption stemming from geopolitical anxieties would tend to raise oil prices to the benefit of producers, trade, labour and capital flows, on the other hand, would be adversely affected through a loss of confidence brought about by the possibility of a regional conflagration.

Qatar may also need to contemplate a period of softening gas prices resulting from increased volumes of LNG hitting the international market in the wake of the shale gas revolution in the US and plans by other countries, especially Australia, to become major LNG exporters.

Lower projected hydrocarbon prices could potentially have significant budgetary implications for all GCC hydrocarbon exporters, NBK said.

Fiscal sustainability is increasingly occupying policymakers’ thoughts, with the Qatari authorities, for example, committed to balancing the state budget entirely through non-oil revenues by 2020.

“The authorities will also need to be cognizant of rising domestic inflation and inflationary impulses associated with project plan execution within a shortening time frame, population growth and rapid non-hydrocarbon sector expansion,” NBK said.