Indian shares edged up yesterday to their latest record closing high, managing a fourth consecutive session of gains as domestic-oriented stocks such as Sesa Sterlite continued to rise on hopes tied to the incoming government led by Narendra Modi.

Modi is expected to be sworn in by early next week amid high hopes from markets that his Bharatiya Janata Party will usher in a period of major reforms that would kickstart an economy growing at its slowest in a decade.

In a sign that the rally may be sustainable, midcaps such as property developer Unitech Ltd are also surging, joining the strong gains by domestic-focused companies.

Meanwhile, IT outsourcers such as Infosys, which had tumbled badly because of a stronger rupee, also recovered.

Still, some analysts urge some caution, given the prospect that the government may fail to meet the high expectations, with broader gains capped yesterday as investors also booked profits in recent outperformers such as Coal India.

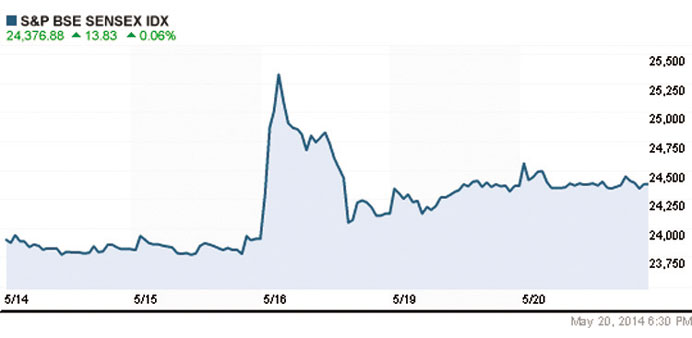

“Markets have run up too fast too soon. The biggest challenge for the incoming government would be food inflation and expectations management,” said Nobutaka Kitajima, chief investment officer at of equities at LIC Nomura Mutual Fund. The benchmark BSE rose 0.06%, or 13.83 points, to a record closing high of 24,376.88, although the index remains below the all-time high hit on Friday.

The BSE is now on the verge of moving past Pakistan’s Karachi Stock Exchange as Asia’s best performing exchange in dollar terms for the year, after gaining 22% so far in 2014.

The broader NSE index rose 0.16%, or 11.95 points, to end at a record closing high of 7,275.50.

Overseas investors have been a big reason for the gains this year, having bought a net of around $14.3bn in shares since Modi was declared the BJP’s prime ministerial candidate on September 13.

Domestically-led shares continued to lead gains. Sesa Sterlite surged 7.9% while Housing Development Finance Corp rose 2.6%. The rally is now also covering smaller companies, sending the NSE midcap index to its second consecutive record high yesterday.

Among the top performers were Unitech, with a 14.6% gain, while Union Bank of India rose 2.4% and private insurer Max India surged 6.8%.

IT exporters also rebounded after taking a beating in the previous two sessions.

Infosys rose 3.5% after falling 7.9% in the last two sessions, while Tata Consultancy Services gained 1.6%.

Defensive stocks also gained after taking a pounding recently. ITC rose 0.8% after falling 8.2% over the last two sessions.

However, broad gains were limited by profit-taking in recent outperformers. Coal India shares, which rose 12.6% on Monday, are down 5.8%, while Oil and Natural Gas Corp fell 4% after gaining 8.5% on Monday.

Rupee snaps 4-day gaining streak

The Indian rupee snapped a four-day gaining streak yesterday, retreating from 11-month highs hit in the previous session after oil importers rushed in to buy dollars, while a rally in domestic shares slowed after powerful recent gains.

Traders said the dollar buying by state-owned banks, which they said was likely on behalf of the central bank, also aided the rupee’s fall.

The intervention was spotted around 58.60 rupee levels, traders said.

The partially convertible rupee closed at 58.63/63 per dollar versus 58.59/60 on Monday.

In the offshore non-deliverable forwards, the one-month contract was at 58.94, while the three-month was at 59.53.