Bloomberg

America’s declining dependence on imports is sapping confidence in emerging-market currencies.

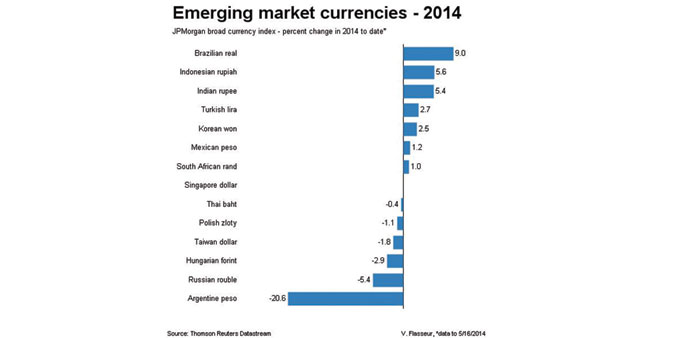

The rally over the past three months from Brazil’s real to Turkey’s lira will be hard to sustain as growing US self-sufficiency in energy, food, machinery, chemicals and industrial goods undermines demand for foreign shipments, according to Goldman Sachs Group, Morgan Stanley and UBS AG. All but three of 23 major emerging-market currencies will retreat by year-end, Bloomberg surveys predict.

“Weakness in emerging-market currencies ebbs and flows but the longer trend may be weaker,” Bhanu Baweja, the London-based head of emerging-market cross-asset strategy at UBS, said in a May 14 phone interview. “Emerging markets benefited from the global imbalances. Global rebalancing is the right thing to do, but it’s not great for emerging markets.”

The proportion of exports from developing nations is falling in part because the US is becoming more reliant on domestic supplies for its energy needs. That’s depriving nations from Argentina to Turkey of foreign currency at a time when growth in some economies is slowing.

Exports from developing countries will expand 5.1% this year, or 1.4 times the pace of global economic growth, according to estimates from the International Monetary Fund. The ratio is little changed from last year and compares with an average of 3.3 times in the decade through 2012.

Argentina’s peso will lead declines, tumbling 18% by year-end, according to the median forecast of strategists surveyed by Bloomberg. The peso has been the worst performer among 24 emerging-market peers in the past three months, weakening 3% as authorities devalued the currency in January after inflation soared and foreign reserves plunged.

The real will fall about 8%, a separate survey signaled, as President Dilma Rousseff, who is seeking a second four-year term, struggles with an economy growing at the slowest pace in a decade and inflation approaching the central bank’s 6.5% upper limit. Brazil’s currency has been the best performer since February 14, climbing 7.9% and reaching a five-month high April 10, supported by interest-rate increases and speculation the central bank would step in to strengthen it.

More than 54% of US imports came from developing countries in 2013, according to data compiled by Bloomberg.

America was Argentina’s fourth-largest export market after Brazil, the European Union and China. The US accounted for 11% of Brazil’s total overseas shipments.

Morgan Stanley has a sell recommendation on emerging-market currencies and advised clients in a May 12 report to stay underweight on South Africa’s rand. UBS, Switzerland’s biggest bank, is advising clients to sell the rand as well as Hungary’s forint.

“Emerging-market trade balances - last year’s problem? Think again,” Goldman Sachs strategists led by London-based Kamakshya Trivedi wrote in a May 8 report. “Pressures may re-emerge” once markets are “shaken out of their stupor and the focus shifts back to macro fundamentals” rather than low volatility, they wrote.

The lira will tumble about 12% to 2.35 per dollar in the next six months, the real will slide 8% to 2.4 and the rand will weaken 7% to 11.1, they predicted. Resurgent investor appetite for higher-yielding assets has helped emerging-market currencies rally from a slump in January.

A Bloomberg index of the 20 most-traded currencies has risen 4.5% from a five-year low on February 3. That followed the worst start to a year since 2009 as the Federal Reserve reined in stimulus and Chinese economic growth slowed. The gauge added 0.2% as of 4:03 pm in New York.

Societe Generale SA, France’s second-largest bank, is among emerging-market currency bulls forecasting further gains.

“The balance of risk is now skewed toward the upside, especially as we are observing some pockets of recovery” in central Europe and Asia, analysts led by London-based Benoit Anne said in a May 9 note.

The Bloomberg Dollar Index, which tracks the US currency against 10 major peers, has fallen 0.9% over the past three months, encouraging Americans to buy home-grown products.

At the same time, official data showed that personal consumption contributed to 68.2% of gross domestic product in December. It was a record 69.1% in March 2011.

US imports of machinery, chemicals, manufactured goods and food grew an average 2.3% in 2013, compared with 9% at the four-year point after the previous four recessions, according to data from Citigroup, the world’s biggest currency trader.

The deficit in the US’s current account, the broadest measure of trade and services, will narrow to 2.1% of GDP this year, the smallest gap since 1997, and economic growth will accelerate, analysts surveyed by Bloomberg predict.

Chinese exports fell 6.6% in March following an 18% slump in February, the most in five years, before rising 0.9% in April.

“Some emerging markets haven’t been able to take advantage of the economic recoveries in developed countries,” James Lord, a strategist at Morgan Stanley in London, said May 14 by phone.

“Strong export growth in emerging markets is the exception, not the norm.”