By Pratap John/Chief Business Reporter

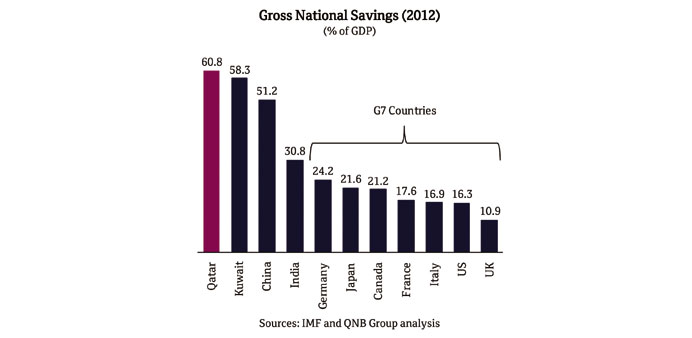

Backed by the highest savings rate in the world, which stood at 60.8% of GDP in 2012, Qatar’s wealth provides “enormous potential” for investments in the non-hydrocarbon sector, a new report has shown.

A major programme of infrastructure investments has been launched to support the diversification of the economy away from hydrocarbons, leading to double-digit growth in the non-hydrocarbon sector, QNB said in its latest “Qatar Economic Insight”.

The main areas of investment have shifted from oil and gas to construction and transport. The bulk of these projects are expected to be completed ahead of the FIFA World Cup in 2022, driving growth over the medium term.

Rapid growth is helping build an increasingly skilled workforce in Qatar. Beyond 2022, Qatar is expected to enter a new human capital phase of growth that will depend on attracting, developing and retaining talent. In line with its National Vision 2030, Qatar aims to transform itself into a knowledge-based economy.

According to QNB, Qatar’s oil and gas wealth per capita is the highest in the world. The country has “enormous” oil and gas wealth, especially in relation to the size of its national population.

It has the third largest gas reserves in the world after Russia and Iran, estimated at 885tn cubic feet (tcf). Along with crude oil and condensate reserves, this equates to proven reserves of around 193bn barrels of oil equivalent (boe) in 2012.

At current extraction rates, Qatar’s proven gas reserves would last another 160 years. With Qatar’s population only at 1.8mn and nationals accounting for only 14% of the total population in 2012, hydrocarbon reserves and revenue per national were the highest in the world, the report said.

The development of Qatar’s huge natural gas reserves has driven its rising wealth. Qatar has invested heavily in the production of liquefied natural gas (LNG) since the early 1990s and became the world’s largest LNG exporter in 2006. The extraction of natural gas has also resulted in a significant production of condensates as a byproduct.

The development of the hydrocarbon sector made Qatar the richest country in the world in 2012 at $101,000 in GDP per capita on a purchasing power parity basis (PPP).

This hydrocarbon-phase of rapid growth in the economy has now reached a plateau as the authorities have implemented a moratorium on further gas development in the North Field until at least 2015 with the exception of the Barzan project.