By Pratap John/Chief Business Reporter

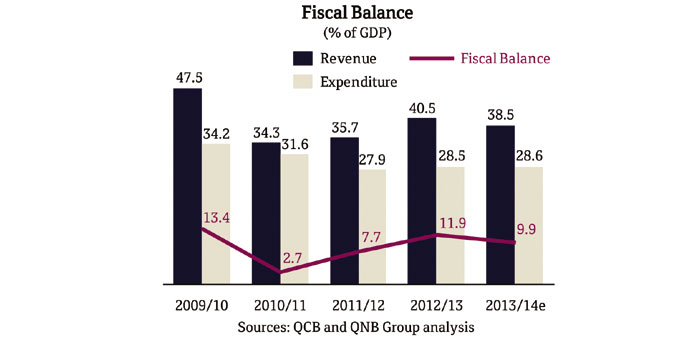

High hydrocarbon prices have sustained Qatar’s fiscal surplus, which remained at 9.9% of the country’s GDP in 2013/14, a QNB estimate shows.

Given that the budget was originally based on a conservative crude oil price of $65 a barrel, the turnout for the fiscal surplus was significantly higher than originally budgeted, QNB said in its latest ‘Qatar Economic Insight’.

Revenue was marginally lower in 2013 than in 2012, owing to lower hydrocarbon prices, which was partly offset by higher corporate income tax collections.

Hydrocarbon revenues accounted for around 80% of total revenue. On the expenditure side, wages and subsidies led to higher current expenditure. Investment spending rose less than expected due to some delays in project implementation.

Qatar current account recorded a ‘healthy surplus’ in 2013 on robust hydrocarbon prices and rising exports of oil, gas and related products such as fuels, petrochemicals and fertilisers. This more then offset the import bill, which expanded on robust domestic demand. A portion of the hydrocarbon revenue is invested abroad through the Qatar Investment Authority (QIA), leading to a capital and financial account deficit.

As a result of the growing stock of foreign assets, investment income from abroad rose to around 3% of the GDP in 2013, up from 1% in 2009, which is reducing the dependence on hydrocarbon export revenue.

The high current account surplus will continue to remain high but at a lower level in 2014-16 on slightly lower oil prices and strong import growth.

Strong export receipts will continue to support the large current account surplus.

“We expect Brent crude oil prices to average $104/b in 2014, with the price falling to about $102/b through 2016. This should help sustain high hydrocarbon export receipts despite the moratorium on further gas developments and the expected stabilisation in oil production.

“Consequently, the current account surplus is forecast to decline gradually to 25.3% of the GDP by 2016 on strong import demand. Reflecting this strong surplus and lower capital outflows, international reserves will continue to grow rapidly. As a result, the reserves import cover is projected to reach 20.6 months by end-2016,” QNB said.

Qatar’s overall balance of payments recorded a healthy surplus in 2013. As a result, international reserves rose to 16.1 months of import cover ($42.1bn) at end-2013, well above the IMF-recommended level of three months of import cover for fixed exchange rates, QNB said.