Indian shares hit record highs for a third session in a row as infrastructure companies such as Larsen & Toubro extended recent gains while lenders including Yes Bank advanced on hopes the worst was over in terms of asset quality deterioration.

Still, broader gains were capped by continued profit-taking in recent outperformers such as Tata Motors, and by falls in regional shares after a survey showed manufacturing activity in China was still contracting in April.

Analysts expect gains to be limited in the near-term as companies post their financial results and India continues its five-week-long election process.

Markets will remain shut today when Mumbai goes to the polls.

“This is the time to be cautious as markets have spiked up substantially. You will have to look out for good quality stocks, where valuation comfort is still there,” said Daljeet S Kohli, head of research at IndiaNivesh Securities.

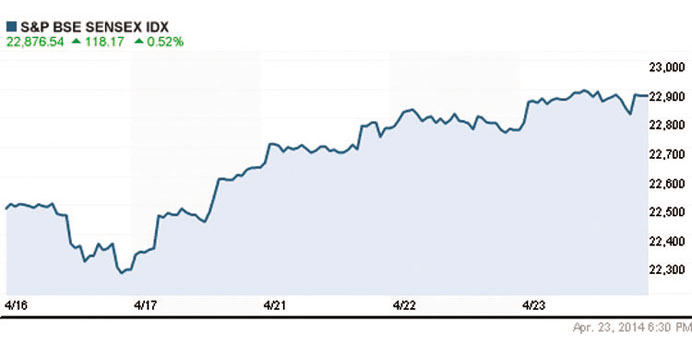

The benchmark BSE index gained 0.52% to close at 22,876.54. The index earlier rose as much as 0.63% to a record high of 22,912.52.

The broader NSE index closed 0.37% higher at 6,840.80, after gaining as much as 0.68% to hit a life high of 6,861.60.

Investors continued to accumulate infrastructure and capital goods stocks, with Larsen and Toubro gaining 2.21% in a fourth consecutive winning session.

Bharat Heavy Electricals gained 1.5%, adding to its 0.24% gain on Tuesday.

Lenders also gained on hopes the worst may be behind them in terms of asset quality which had been a drag in the sector. Yes Bank shares rose 1.6% after its January-March net profit rose 18.8%, while provisions fell 25.9% to Rs722.9mn.

ICICI Bank rose 0.75% and Axis Bank added 1.3% ahead of their financial results on Friday.

Mahindra & Mahindra gained 1.2% after Credit Suisse upgraded the stock to “outperform” from “neutral,” saying its four-wheeler autos and commercial vehicles will benefit from even a short-lived economic recovery. However, recent outperformers continued to see profit-taking with Tata Motors losing 0.87%, adding to its 0.8% fall on Tuesday, while Wipro ended 1.1% lower, falling for the third straight session.

Among the laggards, Cairn India ended 3.1% lower, ahead of its earnings later in the day.

Meanwhile the rupee weakened for a third consecutive session yesterday, falling below the 61 to the dollar mark for the first time in more than a month, hurt by good demand for the greenback from importers and by continued weakness in Asian currencies.

Most emerging Asian currencies fell as the Chinese yuan extended its recent decline to a 16-month low, while the Indonesian rupiah touched its weakest level in more than seven weeks due to increasing month-end dollar demand.

Traders said the direction of foreign fund flows in the near term will remain crucial to determine the rupee’s fortunes, as India continues with its five-week-long elections for which the outcome will not be unveiled until mid-May.

For now, foreign investors have remained buyers with net purchases of a modest $30.80mn on Tuesday, marking a third consecutive day of inflows.

“The rupee is fragile currently and the same is expected to continue till the election result. It is likely revolve around the 60.50 to 61.50 band until May 16,” said Shakti Satapathy, a senior strategist with AK Capital.

“Though a stable political regime would give some short-term respite, the fiscal strategies of the new government would remain crucial in determining the future trend for it”.

The partially convertible rupee closed at 61.07/08 per dollar compared with its close of 60.76/77 on Tuesday. The unit fell as low as 61.19 intraday, its weakest since March 21.

Continued importer demand for dollars this week has helped offset the impact from rising domestic shares, which hit a record high for a third session in a row yesterday. In the offshore non-deliverable forwards, the one-month contract was at 61.48 while the three-month was at 62.30.