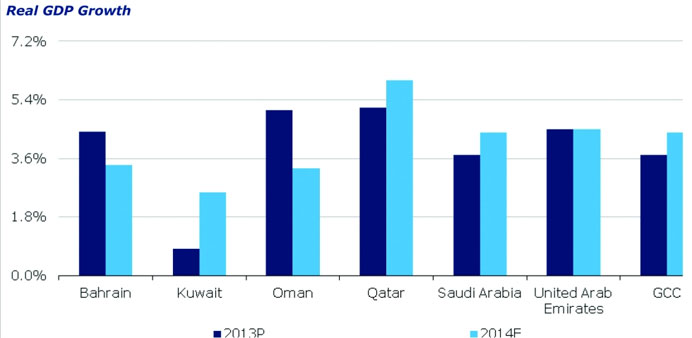

Qatar is expected to lead in terms of growth among GCC countries, growing at 6% in 2014.

By Pratap John/Chief Business Reporter

Boosted by large infrastructure projects and domestic consumption, Qatar is expected to lead in terms of growth among GCC countries, growing at 6% in 2014, Alkhabeer Capital has said in an economic review.

As per the latest IMF data, after exhibiting a subdued growth of 3.7% last year, the GCC economy is expected to expand 4.4% in 2014, it said.

Recently announced budget estimates by the GCC countries for 2014 suggest a growing emphasis on spending on sectors such as education, healthcare and infrastructure.

“These measures are aimed to improve the local human capital and initiate development of high value-added activities in the long run. Governments are targeting greater diversification so that the non-oil private sector starts to play a more significant role in supporting the economy,” Alkhabeer Capital said.

IMF expects UAE's real GDP growth to remain steady at 4.5%, unchanged from the previous year, supported by a number of mega projects in the real estate sector and Dubai's hosting of the Expo 2020 exhibition.

However, the IMF has also warned the country about the potential bubble risks in Dubai’s real estate market and a likely contagion. The UAE Central Bank is taking necessary steps to mitigate these risks.

Saudi Arabia’s GDP growth is expected to increase to 4.4% in real terms, after slowing down to 3.7% in 2013. Private non-oil sector is expected to grow strongly underpinned by a pickup in infrastructure and the mining sector. The recently announced budget continues to promote greater diversification.

Credit rating agency Fitch raised Saudi Arabia’s long-term foreign and local currency issuer default ratings to ‘AA’ from ‘AA-', citing strong balance sheets and government efforts to combat unemployment.

Growth in Kuwait is set to lag other economies in the GCC, growing only by about 2.6%, on account of the higher reliance on the oil sector.

According to Alkhabeer Capital, economic growth in the GCC region will remain largely influenced by oil prices and supply dynamics in the oil industry. Rising supply from Iran and Iraq coupled with lower dependence of the US on imported oil has the potential to change supply dynamics over the medium term.

As the non-oil sector is largely supported by high infrastructure spending, public wages and subsidies, any significant decline in oil prices would not only weaken the fiscal position of the GCC countries but also affect non-oil growth.

Although large surpluses and stable debt ratios should help the GCC countries withstand a temporary decline in oil prices, effective diversification remains the only solution over the long term, Alkhabeer Capital said.