By Pratap John/Chief Business Reporter

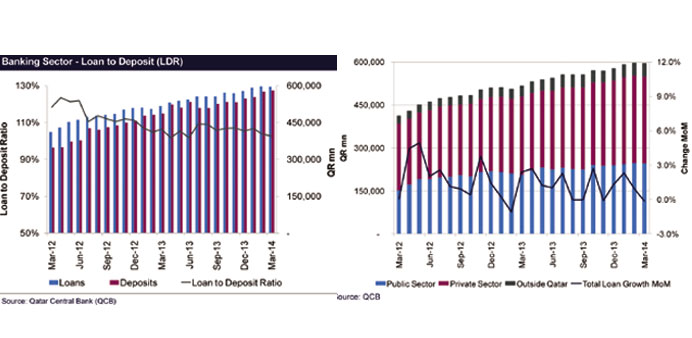

After a relatively “solid” performance in February, the overall loan book with local banks remained “flat”, down 0.1% month-on-month (MoM) in March, QNB Financial Services said in its latest update.

Deposit growth outpaced loans in March, QNBFS said.

However, deposits expanded by 1% MoM last month (up 3.9% MoM in February 2014). Hence, the banking sector’s loans-to-deposits ratio (LDR) decreased to 103% at the end of March 2014 compared with 104% in February.

“Going forward, we expect the public sector, in addition to large corporate loan growth, will be the primary drivers of the overall loan book (growth) in 2014 followed by the SMEs and consumer lending. Our view is based on the expected uptick in project mobilisation in the coming months,” QNBFS said.

Public sector deposits grew by 0.9% MoM in March (up 4.7% MoM in February). Delving into segment details, the government institutions’ sector (represents nearly 57% of public sector deposits) improved significantly by 5.1% MoM compared with a 3.3% growth the previous month.

Further, the government segment increased by 9.7% MoM compared with a 10.5% increase the previous month. However, the semi-government institutions’ segment posted a 30.7% MoM decline continuing its trend as it declined by 0.6% in February 2014.

Private sector deposits gained by another 1.2% (up 4.1% in February 2014). On the private sector front, the companies and institutions’ segment declined by 0.9% (up 4.7% in February) and the consumer segment expanded by 3.3% MoM (up 3.6% in February). Overall, deposits are up 5.9% year-to-date (YTD) in 2014, QNBFS said.

Total domestic public sector loans declined by 0.7% MoM compared with a 1.8% growth in February.

The government segment’s loan book grew by 5.5% MoM after an 8.2% growth in February 2014. However, the government institutions segment, which represents nearly 61% of public sector loans, declined by 0.8% MoM compared with a 1.6% decline in February.

Private sector loans declined by 0.3% MoM compared with a growth of 0.5% in February.

The contractor segment posted the biggest growth, in percentage terms, up 2.5% MoM, while the general trade segment, which contributes nearly 13% to private sector loans loan book grew by 0.3% MoM.

The real estate sector, that contributes nearly 28% to private sector loans, inched up by 0.3% MoM. Overall, loans are up 3.2% year-to-date (YTD) in 2014.

Specific loan-loss provisioning stood at 1.4% of average trailing 12-months’ loans compared with 1.4% in February 2014, QNBFS said.