Reuters/Mumbai

The BSE Sensex and the Nifty yesterday fell to their lowest close in 2-1/2 weeks as software stocks slumped on caution ahead of India’s top IT services provider Tata Consultancy Services’ earnings report later in the day.

TCS rivals Wipro and HCL Technologies will report their earnings today, followed by index heavyweight Reliance Industries on Friday.

Worries that foreign investors, who have pumped $4.8bn into Indian shares so far this year, could be booking profits also weighed. Foreign investors are seen as the primary drivers behind the stock markets’ record highs touched on April 3.

Overseas investors sold Indian cash shares worth Rs216.3mn ($3.59mn) and equity derivatives worth Rs12.18bn on Tuesday – their second straight session of outflows.

Higher-than-expected retail inflation, which quickened to 8.31% in March, driven by high food prices, was also a drag on sentiment.

“Mostly its profit-booking in momentum stocks after record highs. I expect defensives to outperform markets post elections,” said G Chokkalingam, founder of research and fund advisory company Equinomics.

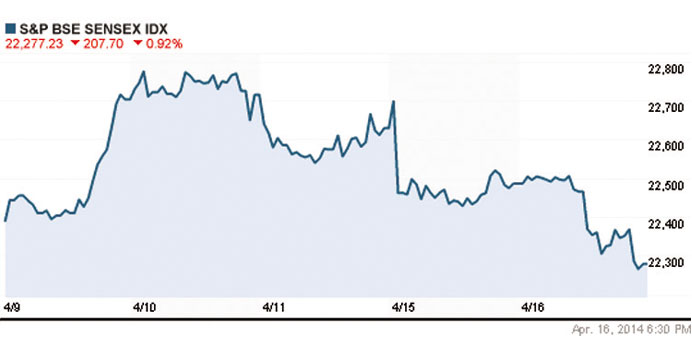

The Sensex fell 0.92%, or 207.70 points, to end at 22,277.23.

The Nifty lost 0.86%, or 57.80 points, to end at 6,675.30.

Both the indexes fell for a third consecutive session, to their lowest close since March 27.

TCS fell 2.5%, Infosys slumped 3.1%, Wipro lost 2.8%, while HCL Technologies ended 0.9% lower.

Among blue chips, Larsen & Toubro fell 2.9% while Kotak Mahindra Bank lost 0.8%.

Reliance Industries fell 0.8% as investors chose to pare positions ahead of its quarterly- earnings on Friday.

Reliance Industries’ operating profit may lag consensus estimates when it reports January-March quarter results on Friday, Thomson Reuters StarMine’s SmartEstimates shows. However, Adani Enterprises surged 3.1%, while Adani Port and Special Economic Zone rose 3.8%, with traders attributing the rise partially to the view that the group would perform well should the Bharatiya Janata Party led by Narendra Modi win the elections, given perceptions of close links between the two.

Meanwhile the rupee dropped for a third straight session yesterday, its worst falling streak since late-January, as profit-taking in the domestic share market by offshore investors hurt the local unit.

Overseas investors, the primary drivers behind the stock market gains, sold cash shares worth Rs216.3mn ($3.59mn) and equity derivatives worth Rs12.18bn on Tuesday – their second straight session of selling.

Investors in India are looking forward to the conclusion of the elections in mid-May. An opinion poll this week forecast that the BJP and its allies would scrape a majority in the 543-seat lower house of parliament. For election related coverage, see

“There is position squaring happening in stock markets ahead of the election outcome and we will see position adjustments in the rupee too. The election result is the key factor for all markets now,” said Ashtosh Raina, head of foreign exchange trading at HDFC Bank.

The partially convertible rupee closed at 60.37/38 per dollar compared with 60.23/24 on Tuesday.

The unit moved in a range of 60.20 to 60.43 during the session.

Traders said gains in other Asian currencies after strong China growth numbers, however, limited the fall in the rupee.

The South Korean won led a rebound among emerging Asian currencies on Wednesday after better-than-expected Chinese first-quarter growth data eased concerns over a sharp slowdown in the world’s second-largest economy.

In the offshore non-deliverable forwards PNDF, the one-month contract was at 60.75 while the three-month was at 61.53.