Emerging equities inched off three-week lows yesterday after Chinese data soothed fears of an abrupt growth slowdown, with gains also filtering through to Russian markets despite simmering geopolitical tensions.

China’s economy grew 7.4% in the first quarter from a year earlier, slightly above forecasts and bringing relief to markets which had been spooked by a recent string of soft numbers.

Gains were muted however, with Chinese shares ending just 0.1% higher and emerging stocks more or less flat on the day. Russian equities rose 0.25%, though they fell around 3% on Tuesday.

US President Barack Obama has warned Moscow it would face further costs for its actions in Ukraine. Fears of civil war are growing as pro-Russian separatists seize more buildings in eastern Ukraine, prompting Kiev to extend an “anti-terrorist” military crackdown.

“Despite the Chinese data or the situation in Ukraine, we are not really seeing any major movements, flows are quite low,” said Murat Toprak, a strategist at HSBC. “We are watching news from Ukraine, everybody is waiting for tomorrow and whether the meeting between the US, Europe and Russia will go ahead ... whether things will calm down.”

He was referring to a scheduled four-way meeting between Ukraine, Russia, the European Union and the US.

The tensions drove Ukrainian debt insurance costs in the credit default swaps (CDS) market to one-month highs of 1,145 basis points, a rise of 27 bps from the previous day, according to Markit data. Russian CDS traded near three-week highs. However, Ukraine’s hryvnia extended the previous session’s gains to hit two-week highs against the dollar around 11.40 after the central bank resorted to an emergency 300 basis-point rate rise late on Monday to support the currency.

The hryvnia has now risen more than 10% this week.

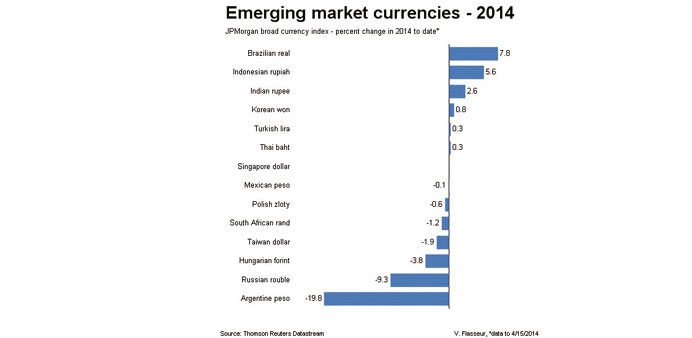

The Russian rouble firmed 0.6% against the dollar , though it has lost almost 3% month-to-date.

Across the rest of emerging Europe, the Turkish lira firmed around half a%, lifted by the generally positive mood. But it has been hurt by signs the central bank is under government pressure to undo some of the recent policy tightening.

In what many see as back door easing, the central bank has reduced average borrowing costs by providing more funding to banks through one-week repo auctions at a fixed 10% rate rather than at higher marginal lending rates.

Markets now await a central bank general assembly that could give the treasury more power over central bank appointments.

“This and other changes could soon force monetary easing even as inflation is accelerating towards 10% and the impact of such a development on Turkish risk premia will be wholly negative,” Commerzbank said in a note.

On bond markets, Romania raised 1.25bn euros on Tuesday with a 3.7% yield and drawing over 5bn euros in demand, showing firm appetite for new issues. Turkish bank Turkiye Finans also sold a sukuk that was three times subscribed, IFR reported.

Bond spreads on the EMBI Global sovereign bond index snapped in three basis points to 320 bps over US Treasuries, away from the widest level since end-March.

The spreads had narrowed to May 2013 levels in recent weeks in line with a risk appetite bounce that had also boosted MSCI emerging equities 10% from their early-February troughs.