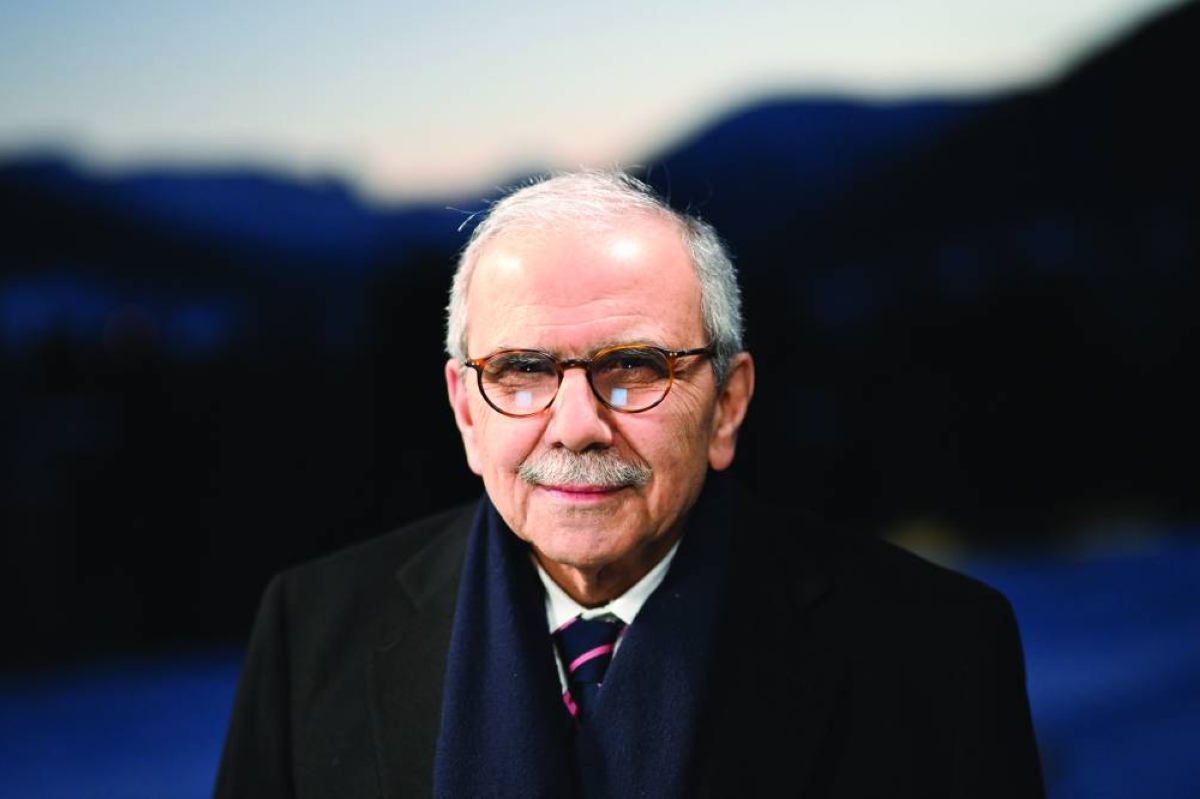

Milaha, which is planning to modernise its fleet, particularly offshore vessels, has laid out plans to strengthen its presence in Kuwait and Iraq, deepen trade flows between Asia and the Middle East, explore new trade opportunities in East and North Africa, and selectively expand operations in Saudi Arabia and the UAE."Milaha’s strategy is firmly focused on strengthening its position as a leading maritime and logistics group through disciplined growth, long-term value creation, and operational resilience," its chairman Sheikh Jassim bin Hamad bin Jassim bin Jaber al-Thani, told shareholders at the annual general assembly, which approved cash dividend of 45% of the nominal share value, equivalent to QR 0.45 per share and appointing KPMG as Auditors for 2026.He emphasised the company's continued investment in strategic assets, fleet modernisation, and integrated service capabilities, enabling Milaha to respond effectively to evolving market demands."For the energy platform, we plan to continue our investment programme in 2026, particularly in offshore vessels, driven by strong demand for long-term production expansion," said the board of directors' report.Milaha’s strategic outlook is strongly aligned with national priorities and focuses on long-term platform growth, the report added.For the trade platform, Milaha said its goal is to expand beyond Qatar by targeting regional and adjacent markets."Our priorities include strengthening our presence in the upper Gulf region (Iraq, Kuwait), deepening trade flows between Asia and the Middle East, exploring new trade opportunities in East Africa and North Africa, and selectively expanding operations in Saudi Arabia and the UAE," it said.The report said the company would also continue to develop industry-specific solutions, such as pharmaceutical logistics, alongside synchronised end-to-end multimodal offerings for major strategic clients in other industries."As we enter 2026, our focus will center on strengthening execution efficiency and completing awarded projects in line with approved schedules, while continuing the modernisation of the fleet and the expansion of operational capabilities," Fahad Saad al-Qahtani, Group chief executive officer said in the report.These "strategic priorities", according to him, would enhance the company's readiness for sustainable growth and reinforce its role in supporting Qatar’s national development trajectory.Highlighting that digital transformation represents a core strategic pillar of its institutional direction; he said, "We have accelerated the adoption of advanced digital solutions and artificial intelligence (AI)–enabled technologies to enhance operational efficiency and strengthen our ability to respond effectively to customer requirements."In parallel, Milaha has continued its disciplined investment in fleet modernisation and strict adherence to recognised environmental standards and best practices, in support of achieving long-term corporate sustainability objectives and reinforcing the responsibility towards the environment and society, he said.Within an increasingly dynamic and rapidly evolving business environment, Milaha has demonstrated a high level of organisational resilience and operational efficiency through the adoption of a disciplined approach to resource reallocation, enhanced asset allocation efficiency, and adherence to a well-considered, risk-based investment strategy, he said."These practices have contributed to mitigating the impact of volatility and reinforcing the sustainability of performance, in alignment with the principles of sound governance and the creation of long-term value," he added.As part of efforts to strengthen its competitive position and consolidate its strategic standing, Milaha has focused on establishing a portfolio of high-quality, long-term strategic partnerships, according to him.Milaha had in 2025 entered into a comprehensive, five-year strategic partnership with Qatar Airways Group in the field of logistics services, aimed at enhancing supply chain integration and improving operational efficiency.It also developed a collaborative partnership with Fincantieri in maritime services and technology, with a focus on knowledge exchange and the adoption of international best practices.Milaha had also signed a memorandum of understanding with NEXX and KEC to develop advanced, AI-enabled logistics solutions, supporting innovation and digital transformation.

Business

Milaha to continue fleet expansion, deepen trade flows between Asia and Mideast

Wednesday, February 18, 2026

Lufthansa unblocks new business-class seats on its new Boeing 787 aircraft

Wednesday, February 18, 2026

‘Qatar, Saudi Arabia should create tourism task force to yield bigger economic footprint per tourist’

Wednesday, February 18, 2026

Tuesday, February 17, 2026

Tuesday, February 17, 2026

Tuesday, February 17, 2026

Wednesday, February 18, 2026

Tuesday, February 17, 2026

Lebanon confident it can bridge gaps with IMF on recovery plan

Tuesday, February 17, 2026

QBA discusses private sector challenges with Ministry of Municipality, Ashghal

Monday, February 16, 2026

Estithmar Holding establishes “Estithmar Capital” for financial investment management

Monday, February 16, 2026