Saudi Arabia’s “non-oil private sector” is expected to be the key growth driver this year, boosted by large public sector infrastructure investment and the rapidly growing population, a QNB report has said.

Saudi Arabia has been one of the best performing G20 economies in recent years with real GDP growth averaging 5.9% a year during 2008-13. The authorities recently announced their 2014 state budget plan, projecting another expansionary budget to continue the process of diversifying the economy.

Based on a conservative oil price assumption of $80/barrel, government revenues and expenditures are expected to be $228bn in 2014. The budget includes substantial additional outlays for education, health and infrastructure, despite expected declines in oil revenues.

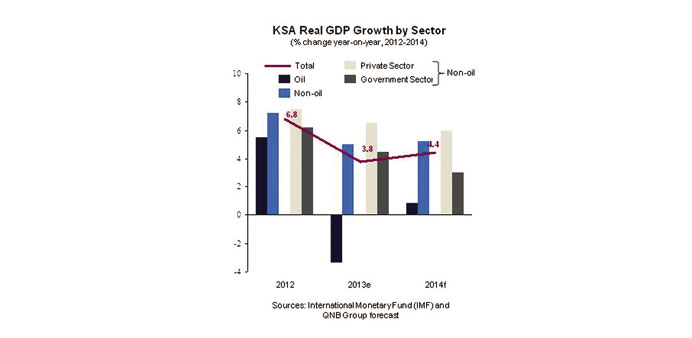

Saudi’s budget announcement included preliminary macroeconomic data, which provides some insight into the authorities’ view on economic performance for 2013 as well as prospects for this year. They suggest that overall economic growth slowed to 3.8% year-on-year in 2013 owing to a decline in oil output. Oil production accounts for just under half of GDP.

Production was raised during 2011-12, mainly to make up for lower exports from elsewhere in Mena (Middle East and North Africa). However, it was cut back slightly in 2013 as production recovered in other Mena countries.

Meanwhile, non-oil growth grew by a robust 5% year-on-year in 2013 as consecutive years of elevated government spending lifted business and consumer confidence and banks’ comfort in lending. In terms of sectors, the budget announcement indicated that the fastest growing sectors in 2013 were the construction (8.1%), followed by the transport and communication (7.2%), as well as the retail sector (6.1%), QNB said.

The non-oil sector is expected to continue growing strongly this year reflecting government-led infrastructure projects, such as the Riyadh metro and a high speed inter-city rail network currently under construction. Furthermore, the authorities are investing $86bn in building the new King Abdullah Economic City in an attempt to diversify the economy away from hydrocarbons into a knowledge-based economy.

On the whole, the value of projects planned or underway was up over a third in 2013 compared with 2012, according to MEED projects data. In particular, Saudi Aramco has major projects underway in the refining and petrochemical sectors, which will extend the economy’s industrial base further, the QNB report said.

The budget announcement stated that the government will continue to allocate funds via specialised credit institutions with $22.8bn being disbursed this year in order to finance industrial projects and thus to support and boost non-oil development. A case in point is the Saudi Industrial Development Fund (SIDF), which has approved 19 loans valued at $747mn for 15 new industrial projects and the expansion of four existing projects, QNB said.