|

|

A growing number of asset managers are looking for better ways to insulate their portfolio from risk given that many types of investment have been moving in lockstep.

One idea gaining ground is known as “factor investing”, which seeks to spread risks by mixing investments within asset classes - challenging the conventional wisdom that bond holdings can offset the risks of holding stocks, for instance.

Traditionally, investors have built a portfolio by first deciding which asset classes - equities, bonds, cash or alternatives - they want to invest in and how much, then picked individual securities within the asset labels.

But that model has come under pressure since the market chaos following the collapse of Lehman Brothers sent many assets moving in the same direction. In some cases investors were unable to trade at all, even when the asset had a top rating. The current focus on an asset’s volatility and liquidity is a direct response.

Using factor investing, asset managers may now focus more on how easily tradeable an asset is. They may buy an emerging market stock and a junk bond that have wild price swings but higher returns, and offset that exposure by adding stable but lower-yielding US Treasuries.

On the face of it, the resulting asset allocation may not look different from one built with a traditional approach.

But the way individual stocks and bonds are selected is based on a different set of risks that investors are prepared to take or avoid, allowing them to be better prepared for the downside.

Rothschild Wealth Management, Norway’s sovereign wealth fund and Swedish and Canadian pension plans are among those who have adopted the model.

“We do not really look at asset classes any longer, that’s not how we build and manage the portfolios,” said Dirk Wiedmann, head of investments at Rothschild Wealth Management. “Traditionally you had the hedge between bonds and equities because of negative correlations. Suddenly this hedge doesn’t work and you have to replace it with something else. The crisis was such a traumatic experience so everyone was forced to go back to the drawing board.”

Rothschild, for instance, ranks the stocks most likely to outperform the benchmark index based on volatility and overweights them.

It also buys put (sell) options to hedge stock market exposure and classifies these under equity allocation, rather than “alternatives”.

“(Factor investing) gives you more flexibility to run a portfolio ... it should give you better understanding of how your (overall) portfolios react because of economic risks,” Wiedmann said.

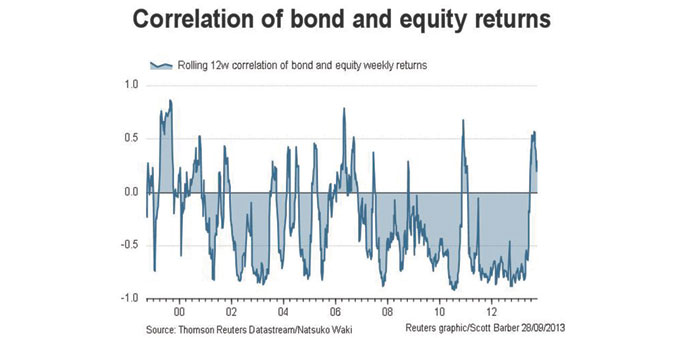

Contrary to popular belief, bonds and equities have not always had a negative relationship where bonds fall when equities rise and vice versa.

Since 2008, bond buying by the world’s major central banks has boosted asset prices across the board, taking stocks in the same direction as bonds.

This year, signs that the Fed could soon slow its money printing has triggered a sell-off in both bonds and stocks.

The three-month rolling correlation of bond and equity weekly returns was positive at the height of the market crisis in 2007 and 2009 and again briefly in 2011.

Since July, correlation has turned positive again. (

According to US money manager GMO, bond/equity correlation between the early 19th century and around the 1980s had been on average positive.

“It isn’t obvious just how much of a diversifier bonds can be at very low yields. Nor do bonds act as diversifying assets to events like the stagflation of the 1970s,” GMO’s strategist James Montier said in a note to clients.

“(Alternatives) had been popular until the global financial crisis revealed for all to see that many alternatives were anything but alternatives.”

Swedish state-owned pension fund AP3, which manages 242bn Swedish crowns ($38bn), has replaced some of its equity exposure with instruments that are sensitive to volatility risks.

“We’ve taken a step away from a traditional asset class view on the portfolio and sliced it into risk classes. We’ve started to target volatility,” said Torbjorn Hamnmark, AP3’s senior strategist of strategic asset allocation.

“From that we have a good experience in generating returns. This year we’re moving into other (types of) risk premia. You are more aware of what kind of risk exposure you have when you start to consider taking this perspective.”

Norway’s sovereign fund has also started adopting the “factor” approach after a 22% loss in 2009 that wiped out returns of the previous 9 years.

“The idea behind factor investing is that nothing comes for free,” said Andrew Ang, an advisor to the fund and a Columbia Business School professor.

“You take factor exposure risks, and factor risk premium is compensation for bearing out these losses. It’s the question of how much exposure you want to take.”