The growth figures for the first quarter of 2013 confirm the continued process of diversification of the Qatar economy away from its traditional role as a hydrocarbon exporter toward a manufacturing and services hub

|

|

Qatar’s real GDP growth is expected to accelerate during the remainder of 2013 reaching 6.5% for the full year and 6.8% in 2014, QNB has said in a report.

This, the bank said will be supported by large infrastructure investments and associated population growth that will more than offset the strong headwinds from the global economy.

“Qatar continues to enjoy a strong economy,” a QNB report said. Qatar’s real GDP expanded at a rapid pace in the first quarter of 2013 (6.2% year-on-year, according to the Qatar Statistics Authority), maintaining the same momentum as in 2012.

At the same time, the current account surplus peaked on robust export performance and inflation remained moderate.

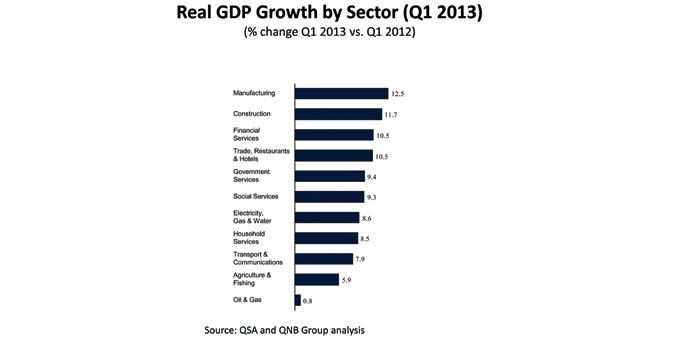

The growth figures for the first quarter of 2013 confirm the continued process of diversification of the Qatar economy away from its traditional role as a hydrocarbon exporter toward a manufacturing and services hub.

Manufacturing was the fastest growing sector (12.5%), boosted by production from the new Pearl gas-to-liquids (GTL) facilities. Construction is booming, growing by 11.7% (6.3% in the first quarter alone)—an indicator that the rollout of Qatar’s infrastructure development programme is gathering steam.

On the other hand, the oil and gas sector—still the largest component of real GDP at 42%—was the lowest contributor to growth, expanding only at an annual rate of 0.8% as maintenance downtime at LNG facilities and fluctuations in oil production in late 2012 affected the first quarter results.

Population growth continues to drive the strong performance in other sectors of the economy.

Trade, restaurants and hotels grew 10.5% in the 12 months to March 2013, boosted by the influx of expatriates required to implement major infrastructure projects.

Financial Services benefited from the booming economy, growing at an annual rate of 10.5% (5.8% in the first quarter alone). Government and social services, together with electricity, gas and water, all grew in line with the additional demand from the growing population.

The actual figures for the first quarter of 2013 are in line with QNB’s full-year forecasts of 6.5% growth in 2013 and 6.8% in 2014, as outlined in the 2013 Qatar Economic Insight report.

The acceleration in economic activity is expected to be driven by large infrastructure projects that are being implemented in Qatar including the $35bn metro and railway project for which contracts have recently been awarded.

Another leading indicator of higher activity comes from population growth, which reached 11.3% in the 12 months to June 2013.

The key driver of growth will therefore continue to be the non-hydrocarbon sector at least until 2015, when the Barzan gas project is expected to start production.

This rapid expansion of the Qatar economy does not seem to be running into supply bottlenecks or asset bubbles, according to QNB Group. Inflation has stabilized at a moderate level (3.5%) in May 2013.

Rents, which are nearly a third of the consumer price index, have recovered from their trough in June 2012, but the rate of rental increases has been slowing in recent months while non-rent inflation has fallen.

The latest data is in line with QNB Group’s forecast for 3.5% inflation in 2013 as a whole, increasing slightly to 3.8% in 2014.

Recently released balance of payments data also provide a further indication that the economy is strengthening. The current account surplus rose to 38% of GDP in the first quarter of 2013, boosted by strong export growth (11%).

QNB Group expects a small moderation in the current account surplus to 35% of GDP for 2013 as a whole reflecting lower oil prices and a pickup in workers’ remittances.

The financial account deficit narrowed as outflows of investment slowed sharply from $16bn in Q4, 2012 to $9bn in Q1, 2013. QNB expects the financial account deficit to narrow further as investment outflows will continue to moderate.

With strong growth, stable inflation and high current account surpluses, Qatar’s economic outlook remains strong, QNB said.

“Large fiscal and current account surpluses should provide Qatar with ample resources to invest in major infrastructure projects, pushing further the process of economic diversification into a manufacturing and services hub,” the report said.