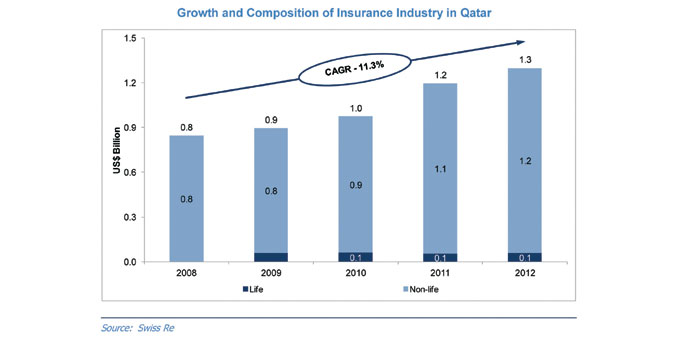

Driven by Qatar’s economic development and rising population, the country’s insurance industry expanded at an annual average growth rate of 11.3% between 2008 and 2012 and reached $1.3bn, a new study has shown.

According to Alpen Capital, Qatar trailed behind Kuwait in terms of total gross written premiums (GWP) in the insurance industry until 2006.

The Qatari market outperformed its closest GCC counterpart (Kuwait) expanding at an annual average growth rate of 11.3% between 2008 and 2012. This growth can be attributed to a combined impact of economic progress, substantial focus on infrastructure development, increasing population, and compulsory insurance regulations.

Insurance penetration in Qatar stood at 0.7% in 2012, only slightly above that in Kuwait. Since 2009, it has declined significantly as the overall GDP growth outpaced the rate of expansion of the insurance industry.

However, insurance density at $706.9 was significantly higher than that of Kuwait. The life insurance market has evolved to a perceptible size only since 2009, before which almost the entire insurance premium in the country was contributed by the non-life segment.

Even as the life insurance market accounted for less than 5% of the total industry in 2012, Qatar stood favorably in terms of overall insurance density compared to the GCC (Gulf Co-operation Council) average due to a sizeable non-life insurance sector.

In fact, Alpen said, the country presents a contrasting picture of insurance density between the life and non-life segments at the regional level. While it had the second-lowest density in the life insurance segment in 2012, it ranked second from the top in non-life insurance density.

Until recently, the Qatari insurance sector was regulated by the insurance law of 1966, which imposed a number of restrictions such as permitting only a national insurer to insure properties within Qatar, restricting foreigners from operating as insurance agents or owning such entities, and requiring all Qatari insurance companies to be established as joint stock companies completely owned by nationals.

In December 2012, the Emir of Qatar passed the Law of the Qatar Central Bank and the Regulation of Financial Institutions. The new law paved the way for a single regulator in future. The law also transferred the responsibility of licensing and supervision of all insurance companies, reinsurance companies, and insurance intermediaries from the Ministry of Business and Trade onto the Qatar Central Bank.

The QCB is expected to publish further details on the new regulatory structure for the insurance industry in due course.

Health insurance likely to see higher industry representation

Qatar’s health insurance segment is likely to see a higher industry representation in future with the implementation of a compulsory medical insurance programme in the country, Alpen Capital said in a report.

Currently, health insurance does not constitute a large slice of the industry as it does in some of the other GCC (Gulf Co-operation Council) markets. Government benefits by way of free and subsidised healthcare for nationals and expatriates respectively have curtailed growth of this segment.

Other personal lines of insurance like property and life have also experienced a slow progress due to high social spending and influence of cultural beliefs, the report said.

The life insurance segment also remains highly underdeveloped, and the principal market for conventional life products is the large composition of expatriate residents in Qatar.

Energy, marine, and construction are the major lines of insurance in Qatar given its robust hydrocarbons sector, and are likely to remain prominent in the foreseeable future. Third-party motor insurance is compulsory, and the segment accounts for a large portion of the personal non-life insurance market. It is the most competitive business line, generating low margins for the service providers.

Qatar’s insurance industry consists of a relatively fewer players than other GCC countries, thus making the market more concentrated particularly at the top.

Currently, there are 27 licensed insurance and reinsurance companies in the country. Government sponsored projects are mainly covered by domestic companies. Subsequently, the market is largely controlled by these companies, with Qatar Insurance Company (QIC) holding a dominant position and representing more than 50% of gross written premiums in the country.

Given the majority contribution of commercial lines in the overall insurance premium and lack of necessary expertise, the primary insurance players in Qatar rely heavily on reinsurance companies to cover risks.

Most of the insurance companies either cede their entire premium or retain less than 10%. The country has one of the highest cession rates in the region, and large international companies have emerged as key players in the reinsurance market.

Motor and medical insurance are the two businesses retained to the highest extent in Qatar. Nevertheless, over the years, retention rates of primary insurers have increased due to change in product mix in favour of health insurance products and improvement in the level of expertise. Distribution of insurance products in Qatar is primarily through the direct channel and intermediaries account for approximately 25% of total premium written, especially in the personal business lines.