Qatar’s public spending will gather pace over the next two years, keeping the overall GDP growth at more than 5% as the country looks towards infrastructure improvements, a new study has shown.

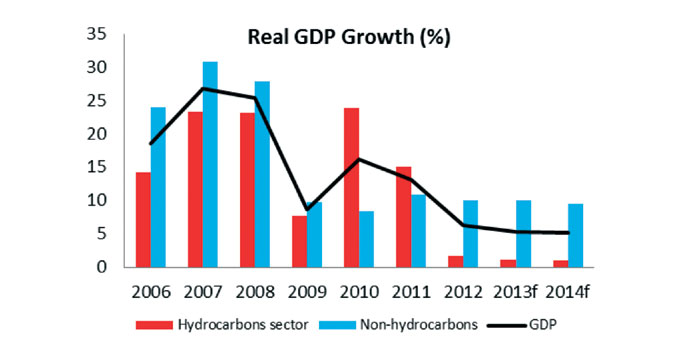

The latest national accounts data from the Statistics Authority show that real GDP growth reached 6.2% last year, driven by a 10% expansion in the non-oil sector, while the hydrocarbons sector slowed (as expected) to 1.7%, said Samba Financial Group in its latest country report.

Manufacturing and construction grewing 11.8% and 10.6% respectively, while services were also up 9.2%.

“The robust expansion in the non-hydrocarbons sector bodes well for Qatar’s economy as growth shifts away from the earlier massive expansion in hydrocarbons production, particularly LNG. At 10%, the rate of growth is faster than the 9% envisaged in the National Development Strategy (NDS), and suggests that progress with the plan implementation is broadly on track and that the 2022 World Cup is acting as a catalyst,” Samba said.

Qatar’s current account surplus rose last year, the report said, despite a surge in imports, stabilisation in oil price, and weaker crude output.

Preliminary estimates suggest a surplus of around $56bn in 2012, or nearly 30% of GDP, aided by higher than expected non-oil hydrocarbon earnings which pushed exports up 17%.

Official foreign exchange reserves also grew to $33.1bn at end- 2012, providing an estimated 8.7 months of import cover (goods and services), and were holding at $35.8bn in February.

There will also have been further accumulation of foreign assets through the Qatar Investments Authority (QIA). The Institute of International Finance (IIF) projects sovereign assets at $231bn for 2013.

The resilience of hydrocarbon export earnings also ensured that the government beat its budgeted revenue estimates and helped deliver an increase in the estimated 2012/13 fiscal surplus to 11.8% of GDP (around $20bn).

“Looking ahead we would expect to see some decline in both surpluses as hydrocarbon earnings soften and public spending, which stalled in 2012, picks up again. That said we expect both balances will remain healthy,” Samba said.

Preliminary estimates show that public spending was about 5.5% below budget in 2012/13 at $43.6bn, mainly on account of large undershoots in capital spending.

This, Samba said, may well reflect some prudent reviews of spending plans and reprioritisation as part of the medium-term budgeting exercise still underway; as well as implementation constraints and sequencing issues.

That said, the new 2013/14 budget looks set to make up lost ground, with planned expenditure up 18% over 2012/13 at $57.9bn.

Budget revenues are put at $59.9bn (less than the $65.6bn recorded for 2012/13), leaving a projected surplus of $2bn.

However, revenues, which are based on a $65/b oil price assumption, are likely to be exceeded. In addition, it may be hard to meet the projected $20.6bn in planned capital spending (thought to be focused on transportation, urban and utilities projects), suggesting that the fiscal surplus will again be larger.

“We project a figure closer to 6% of GDP, on an average oil price of just under $100/b for the fiscal year. Given our expectation of weaker oil prices going forward and sustained implementation of spending plans, this surplus is likely to shrink to 4.5% in 2014/15,” Samba said.

Total deposit growth

runs at 40% y-o-y

Total deposit growth in Qatar in running at about 40% year-on-year (y-o-y) with private sector deposits also showing some growth, Samba Financial Group said.

“The combination of strong deposit growth and easing credit growth has helped push the aggregate bank loans to deposit ratio back below 100%,” it said.

A continued build up in public sector deposits is helping banks finance their fast growing balance sheets, although many have also looked to raise longer term funds globally.

Public sector deposits grew by $15bn during 2012, and another $3bn has been added through February, bringing the total to $52.4bn.

Non-resident deposits have also surged and grew $4bn over the last five months to stand at $12.2bn in February.

The strong rate of domestic credit growth has eased off somewhat, although at 22.2% y-o-y in February, the rate remains relatively high.

Massive increases in lending to the public sector for its extensive infrastructure investment programme have been the main driver of credit growth and, although slowing in recent months, public sector credit was still growing 35% y-o-y in February.

Meanwhile, private sector lending has been healthy at 13.7% y-o-y, although within this real estate lending has trended down to 7.6%, and consumption loan growth has stagnated.