The US economy may be slowing again as higher taxes and lower government outlays lead to reduced consumer spending and manufacturing, QNB has said in a report.

However, strong infrastructure spending and relatively high oil prices should continue to protect Qatar and other GCC countries from these latest headwinds from the US economy, it said.

Recently, the US Department of Commerce said consumer spending, which accounts for about 70% of US GDP, declined by 0.2% in April, the first such decline in nearly a year.

This decline partly reflects the impact on US consumers of higher payroll taxes in 2013. In addition, the so-called “sequestration” of government outlays since March 2013 is leading to lower incomes of government workers and contractors.

An estimated 2mn government workers have been forced to stay at home without pay a couple of days per month. As a result, US personal disposable income was unchanged for the month of April.

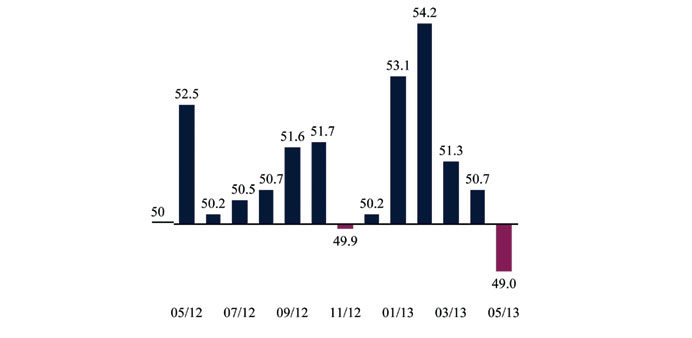

In related news, US manufacturing contracted in May 2013 for the first time in almost a year with the lowest reading since June 2009, according to the Institute for Supply Management.

Manufacturing has traditionally been a bellwether for overall US economic activity. In addition, real GDP growth for the first quarter of 2013 was revised down to 2.4% last week and initial jobless claims rose to 354,000 in the week ending May 25.

On the positive side, US consumer confidence remains at a five-hear high, boosted by higher housing and share prices.

These latest statistics suggest that the US economy is likely to slow down during the remainder of 2013, the QNB report said.

The economy had already experienced a significant slowdown in the fourth quarter of 2012 (0.4%), which Fed Reserve chairman Ben Bernanke described as a “pause” earlier this year. That pause was mainly a reflection of weak holiday sales and a cutback in private investment.

This latest slowdown, on the other hand, comes from the significant withdrawal of fiscal stimulus through the partial elimination of the so-called “Bush tax cuts” and the mandatory cutbacks in government spending.

If continued, these policies are likely to result in a further drag on economic activity as more budget cuts from the “sequestration” negatively impact personal disposal income, consumer spending, and manufacturing.

Overall, the picture for the US economy remains subdued.

According to the QNB Group, US real GDP growth this year may only reach the 1% to 1.5% range, compared to the consensus forecast of 1.9%, which will inevitably have a knock-on effect on the world economy.

As a result, global demand for commodities is likely to be weaker, including for oil and gas. At the same time, lower US demand for exports from Europe may affect the speed at which the Euro area recovers from the current recession.

Export industries in Asia and the rest of the world are also likely to be affected.

In the currency market, lower US growth may lead to a weakening of the US dollar against other major currencies.