|

|

Qatar’s proven gas reserves estimated at 885tn cubic feet (tcf) will last around 160 years at the 2011 production rates, a new study has shown.

Qatar had the third largest gas reserves in the world as of 2011, QNB said in its soon-to-be-published ‘Qatar Economic Insight 2013’.

Qatar’s vast gas reserves are located in the offshore North Field, which is the single largest non-associated gas field in the world. The government has placed a moratorium on further project developments in the North Field until the completion of a study into reservoir management and sustainable development are finalised.

However, the Barzan domestic gas development project and Block 4 North (a new gas field discovered in March 2013 with an estimated 2.5tcf of recoverable gas) are not subject to the moratorium.

Block 4 North is the first gas find in 42 years and suggests potential for further discoveries in the future, QNB said.

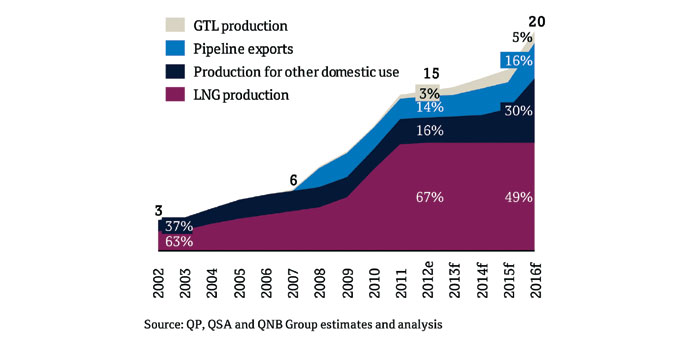

Gas production has increased from 6bn cubic feet a day (cf/d) in 2007 to around 15bn cf/d in 2012. Production has witnessed an upsurge over the past few years in order to supply new LNG and GTL facilities; industrial projects, particularly in the petrochemicals sector; and power generation plants.

The main driver of higher gas production has been investment in the production of LNG. LNG exports started in late 1996 and stood at 2.2m tonnes per year (tpy) in its first full year of exports in 1997, QNB said.

Qatar has been the world’s largest LNG exporter since 2006, with export volumes nearly reaching its production capacity of 77mn tpy in 2012.

Qatar’s main export market has historically been Asia, but it has expanded into new markets in Europe and the Americas and now covers some 23 countries across the globe.

According to QNB, Qatar accelerated its expansion by strategically investing in regasification terminals abroad to facilitate the distribution and storage of LNG.

It currently manages three LNG regasification plants (South Hook in the UK, Golden Pass in the US, and Adriatic in Italy).

The future expansion of gas production will be driven by the Barzan project that is estimated to bring on-stream an additional 1.5bn cf/d and new discoveries that are likely to add a further 0.7bn cf/d by 2016.

The share of gas used for LNG is likely to drop as the moratorium on North Field gas remains in place, and the additional output is used for domestic power and industrial uses.

An increase in pipeline exports to the UAE through the Dolphin project is also under negotiation and is likely to take some additional output, QNB said.