New techniques for extracting hydrocarbons, that were previously not economical, are changing the rules of game for the global oil and gas, particularly in the US, making it a net exporter of gas and self-sufficient in oil by 2030, QNB has said in a report.

Barring a few frontier areas, such as the Arctic, it is widely believed that most major conventional fields have been discovered. Moreover global conventional crude production seems to have peaked and to be in gradual decline.

However, the decline is being more than offset by new production from “unconventional” reserves. The distinctions are fuzzy, but generally this term refers to oil and gas that is more complicated to exploit either because of the kind of rocks it is located in, its concentration levels or its chemical composition. In recent years, oil and gas companies have refined techniques for exploiting these kinds of reserves.

The most attention has been given to shale gas, which is unlocked through fracturing the impermeable shale rock by pumping water, sand and lubricants through horizontal drill holes. This technology, called fracking, is expected make the US self-sufficient in gas within about four years, and a net exporter thereafter.

Similar techniques are being used to extract previously inaccessible oil, known as “light tight oil”, also locked away in shale and sandstone rock formations. The prime example of tight oil production in the US is the Bakken shale formation in North Dakota.

Oil has been produced from the region since the 1950s, but at low levels. However, as the new techniques have been introduced, production has soared from just 10,000bpd in 2006 to 719,000bpd in March 2013.

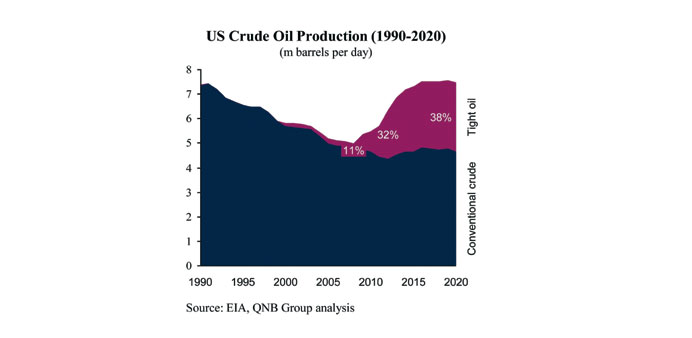

In total, the US’s Energy Intelligence Administration (EIA) estimates that its tight oil production reached 2mn bpd in 2012, up 0.8mn bpd in 2011. Its share of US crude production has risen from 11% in 2010 to 32% in 2012.

The EIA forecasts that US tight oil production will rise a further 0.8mn bpd by 2020, when it will represent nearly 40% of US crude production. The latest medium term forecast from the International Energy Agency (IEA) is more bullish.

It forecasts an additional 1.5mn bpd over 2012 production by 2018. This would mean that US tight oil would provide over a quarter of the new crude production globally until 2018, more even than Iraq is expected to contribute. BP is even more optimistic, forecasting that US tight oil production will increase by 2.8mn bpd by 2020.

Earlier, IEA forecasts suggested that the US could overtake Russia and Saudi Arabia to become the world’s biggest oil producer (including condensates and natural gas liquids) as soon as 2017. Moreover it expects the US to become energy independent by 2030. By contrast, in 2011, the US depended on oil imports for 45% of its consumption.

Outside the US, the IEA does not see tight oil production being developed in a significant way before the end of this decade. As with shale gas, other countries will struggle to replicate the US tight oil boom because of specific local factors.

In particular, the US has a strong oilfield services sector and a large fleet of drilling rigs, which is essential given the greater work required to extract tight oil than conventional crude (over 5,000 rigs are now operating in the Bakken Shale alone).

The largest reserves of tight oil are estimated to be in Eastern China. The German Federal Institute for Geosciences and Natural Resources (BGR) estimates that there could be around 300bn barrels of recoverable tight oil in China, more than 10 times the (conservative) estimates of US reserves. BP gives more conservative figures, estimating just 240bn barrels of technically recoverable tight oil reserves globally. Nonetheless, it sees tight oil production growing by 9m b/d globally by 2030, proving more than half of the growth in global crude production over this period.

QNB Group notes there is considerable uncertainty about the likely pace of tight oil production growth both in the US and globally.

While it will certainly boost global oil supply, its high production cost, currently around $50-$70 a barrel, means that it is unlikely to cause substantial downwards pressure on global oil prices.

Moreover, Khalid al-Falih, chief executive of Saudi Aramco, welcomed the tight oil developments during a recent visit to the US. He argued that the possibility of tight oil production will reduce concerns about security of supply and lock in demand for oil for the long term, in favour of other energy sources, benefiting major conventional producers.