Improving liquidity and enhanced economic activities are set to generate greater demand for credit in the country with the country’s banking sector estimated to see growth in loan disbursement of up to 20% in 2013, a new study has shown.

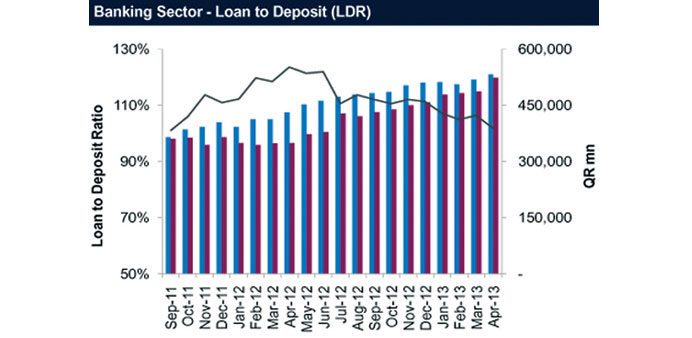

Liquidity has “materially improved” with the current loan-to-deposit (LDR) ratio at 102% compared with a 2012 high of 124% recorded in April, QNB Financial Services (QNBFS) said in its latest report.

But it expects the net interest margin (NIM) to remain under “some pressure” throughout this year.

However, the local banks have seen a deposit growth of 14.2% year-to-date (ytd) and 7.4% month-on-month (m-o-m) in April, driven largely by the public sector.

On the other hand, the sector has seen the overall loan book tick up by 4.2% (ytd) and 2.7% (m-o-m), again driven by the public sector.

“We continue to expect growth in public sector loans to pick up in the coming months and then grow thereafter as project mobilisations pick up,” QNBFS said.

Many believe the private sector would make real benefits once projects get kick-started, which is expected in the second half of this year.

Recently, Public Works Authority (Ashghal) said it would invest QR100bn in infrastructure development projects in Qatar within the next five years.

Just a few days ago it awarded contracts totalling QR1.2bn, covering seven major projects, including new health centres and additional operation theatres at Hamad General Hospital.

The projects are part of Ashghal’s ambitious QR14.2bn plans for 2013-14 to develop some 124 building projects across the country.

Recent reports indicate Qatar plans to award some 30 major road building projects worth QR100bn to construction companies this year.

The transportation sector takes a lion’s share of leading projects in the country with the metro-rail, expressway and Doha Bay initiatives topping the list. In addition, many major projects are expected to be awarded in 2013.

QNBFS said the public sector deposits grew by 13.8% and 16.3%, m-o-m and year-on-year (y-o-y ) respectively in April. The government and its institutions segments contributed to the bulk of this growth.

The government segment increased by 6.8% m-o-m (24.7% y-o-y ), while the institutions segment (representing 62% of public sector deposits) expanded by 6.8% m-o-m (up 24.7% y-o-y).

Private sector deposits grew by 3.4% m-o-m (up 14.3% y-o-y).

The consumer segment “modestly grew” by 3.2% m-o-m (up 12.7% y-o-y), while the companies and institutions segment increased by 7.4% m-o-m (up 14.2% y-o-y).

Net total deposits (including deposits outside of Qatar) grew by 7.4% m-o-m (up 14.2% y-o-y). Most of the growth in deposits during 2012 was seen in May and July.