By Pratap John/Chief Business Reporter

Benefitting from Qatar’s large public spending programme on the back of higher energy prices and increased gas production, local banks have seen huge asset gains with a 20% compounded annual growth rate (CAGR) in one year up to March, a new study has shown.

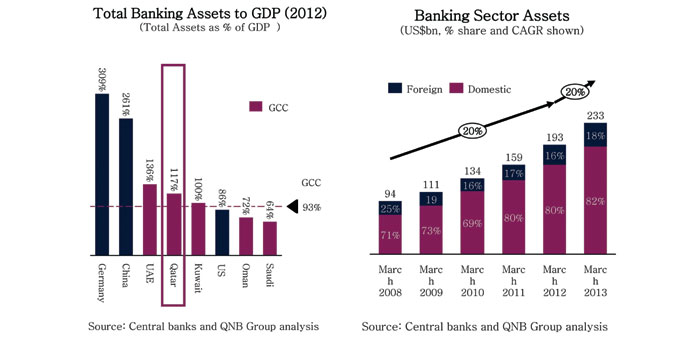

The country’s banking system had seen similar asset gains with a 20% CAGR between March 2008 and March 2012, QNB said in its soon to be published “Qatar Economic Insight 2013”.

Total banking assets to GDP increased from 97% in 2008 to 117% in 2012. This is higher than the GCC average of 93%, but still comparatively lower than some major economies such as Germany and China, the report said.

The main driver for Qatar’s banking growth was domestic assets, which in turn was driven by a 27% growth in credit (and accounts for 71% of domestic assets).

Conventional banks account for the largest share of assets (72%) and, therefore, were largely responsible for the strong growth with their balance sheets expanding by 18% in 2012, QNB said.

The top five banks in Qatar accounted for 77% of total banking sectors assets in March 2013. QNB is the largest bank in Qatar and the Mena region with total assets of $104.4bn as of March 2013.

QNB has also put Qatar on the global banking landscape by emerging as “The strongest bank” in the world for 2012 based on a recent survey by Bloomberg Markets.

The sector’s overall credit facilities increased by 25% to $142bn in the year up to March 2013. Credit facilities to the public sector accounted for the largest portion (40%) of overall loans as of March 2013.

The public sector was also the key growth driver for overall gains in banking sector deposits. Deposits from the public sector rose sharply by 83% year-on-year as of March.

Although the rapidly increasing public sector deposits form a stable source of funding for the Qatari banks, they have also been “widening their funding options” in recent years, QNB said.

Banks have been tapping into international bond markets and in 2012 issued bonds to the tune of $4.5bn.

“Qatari banks have high credit ratings, along with a record of generating consistently strong growth in their operations and financial results. This has allowed them to successfully access international debt markets and find funding options at competitive rates,” QNB said.

The net profit of Qatari banks increased by 7.5% in 2012 to reach $4.4bn. The return on average equity (ROAE) stood at 17.5%, while the return on average assets was at 2.7%. Higher lending, a low cost base and low provisioning requirements have supported the banks’ overall profitability.

“We expect Qatar’s banking sector to maintain its profitability in 2013-14. It is expected to continue on its strong growth trajectory also taking into account further global expansion by local banks,” QNB said.

Qatari banks have been swiftly expanding their global footprint in recent years. Most local banks already have an international presence through branches and offices.

In addition, a number of Qatari banks have acquired a stake in financial institutions in the Mena region and other select markets. Current plans will see continued expansion by local banks.

QNB has the largest international network among Mena banks, with a presence in some 25 countries. Other local banks are also actively seeking international growth opportunities.

“Qatari banks will continue to look at international expansion in 2013-14 as global banking asset prices remain attractive and as Qatar rapidly expands its international investments, providing related banking needs and opportunities,” QNB said.

NPLs at international low

The ratio of non-performing loans (NPLs) to total loans in Qatar was just 2% in 2012, much below the international average, QNB said.

This essentially means Qatar’s banking sector asset quality remains stronger than in many countries in the world.

Qatar’s banking system also has sound capitalisation, with a capital adequacy ratio of 19%, far above Basel requirements.

Total banking assets to GDP increased from 97% in 2008 to 117% in 2012, QNB said.