AFP/London

European equities rallied yesterday with star performer Frankfurt striking a record high following impressive company earnings and upbeat data, and after Australia cut interest rates.

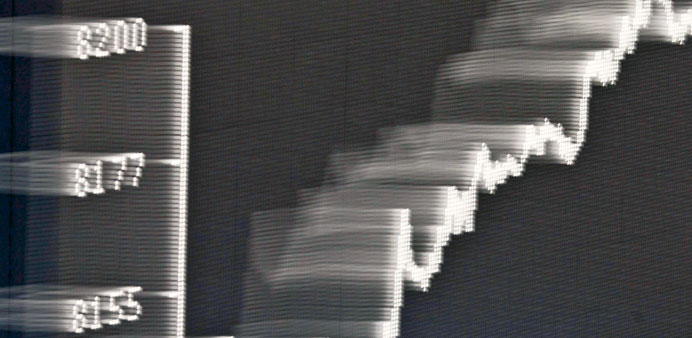

Germany’s Dax 30 index of leading shares jumped as high as 8,197.72 points, surpassing its previous July 2007 record, with the market lifted by impressive factory orders data.

Sentiment was further boosted after the Reserve Bank of Australia (RBA) cut interest rates to a record low in a surprise decision, one week after a reduction from the European Central Bank.

Later the Dax stood at a closing record of 8,181.78 points, up 0.86% from Monday.

Elsewhere, London’s FTSE 100 index of leading companies rose by 0.55% to 6,557.30 points, while in Paris the Cac 40 gained 0.37% to 3,921.32 points.

On Wall Street, the markets mostly moved higher.

On the London Bullion Market, gold fell to $1,444.25 an ounce from $1,469.25.

In foreign exchange activity yesterday, the European single currency firmed to $1.3085, from $1.3074 late in New York on Monday.

At around midday, the Dow Jones Industrial Average rose 0.28%, while the S&P 500 added 0.18%, but the tech-rich Nasdaq Composite Index slipped 0.04%.

“The German Dax index has finally caught up with its US counterparts — the Dow and S&P 500 — in climbing above the 2007 highs,” said GFT Global Markets analyst Fawad Razakzada.

“Investors are piling into equities ... with the RBA becoming the latest major central bank to further loosen its policy overnight.” He added: “Low interest rates discourage investment in fixed income, making equities attractive alternatives.”

Major European markets had been slightly weaker on Monday, with London closed, as investors digested solid gains that were notched up last week following the ECB rate cut and upbeat US non-farm payrolls data.

Yesterday saw a raft of upbeat quarterly earnings reports from Dax heavyweights such as insurers Allianz and Munich Re.

Allianz shares gained 3.56% to 120.70 euros, while Munich Re shares edged up 0.65% to 149.25 euros.

In Paris, Societe Generale’s share price surged 5.68% to €30.14, as traders shrugged off falling quarterly profits to focus on the French bank’s new cost-cutting drive.

And in London, Asia-focused banking giant HSBC announced that net profits more than doubled to $6.35bn (4.86bn euros) in the first quarter, aided by tumbling bad debts and cost cutting.

An image made with a camera movement of the display board showing the highest recorded Dax index at 8,197.72 during daily trading at the German Stock