The Qatar government spending will be higher than the budgeted $58bn in 2013/14 and may reach $66bn this financial year, QNB said as the country gets ready to tender planned major infrastructure projects within the time-frame set for FIFA World Cup 2022 soccer tournament in Doha.

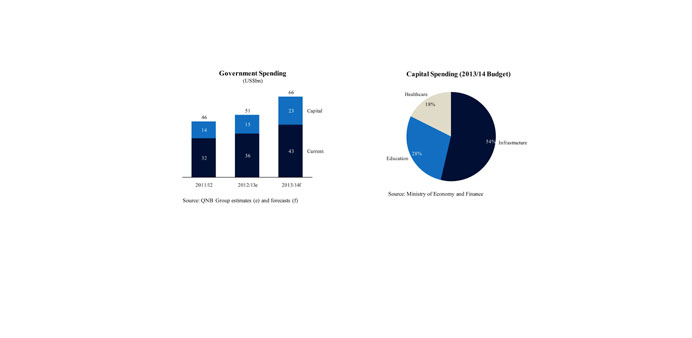

This, the bank said, leaves a budget surplus of $8bn, or around 4% of GDP. QNB estimates that 30% of the total expenditure will be on capital projects.

Qatar has taken $65 per barrel as the conservative price on which the budget for 2013 / 14 is to be based.

On this basis, the Ministry of Finance and Economy has assumed revenue of $60bn, of which it plans to spend $58bn.

However, QNB expects oil prices to be considerably higher, averaging $107/barrel for the fiscal period and leading to estimated revenue of around $74bn.

This will leave room for significantly higher spending than planned. Qatar, as with most GCC countries, tends to spend considerably more than budgeted as budgets are based on conservative oil price assumptions.

In the fiscal years from 2009/10 to 2011/12, Qatar’s actual spending was, on average, 20% more than budgeted.

Furthermore, there are indications from recent trade and population data that project activity has been picking up since end-2012.

The government’s spending growth slowed in early 2012 as it consolidated expenditure plans and adopted a new medium-term budget framework.

However, spending is now likely to be ramped up as major infrastructure plans are being tendered in order to be completed within the timeframe required for the 2022 World Cup.

The largest category of budgeted current spending is government salaries, which accounted for 35% of the total in the 2013/14 budget. The remainder is mainly non-salary items for government departments, such as general supplies, external services and debt interest.

The largest department is general administration followed by defence and security, education and health.

While capital spending lagged in 2012/13, the current ramp up in projects will lead to an increase of an estimated 29% in 2013/14. Capital spending in the budget can be broadly categorised into three areas: infrastructure, education and health.

The allocation for infrastructure development went up by 28% and it accounts for 54% of the capital spending budget. This spending will mainly be directed towards the rail network, roads, real estate, the new Doha port and expansion of utilities network.

Qatar Rail is an estimated $35bn project with initial phases set for completion by 2020. It involves 300km of railways, including passenger and freight, and a metro and light rail network in Doha.

The initial phase involves the core elements of the Doha metro and light rail network. Around $12bn is currently being tendered for 62km of underground structures and 30km of elevated structures.

The road projects are mainly led by Ashghal, which has two major projects. First, the $14.6bn local roads and drainage programme, mainly upgrading the network of roads in Doha, with completion expected in 2016.

Second, $8.1bn of projects to build the Doha, Lusail and Dukhan highways with completion expected in 2016. There are a number of additional smaller road projects, amounting to more than $1bn with completion expected between this year and 2016.

The $5.5bn Musheireb real estate regeneration project in the centre of Doha will also receive allocations from the government’s capital budget.

The development is expected to be completed in 2016 and house more than 27,000 residents. It also includes commercial, retail, cultural and entertainment areas.

Education accounts for 28% of the capital spending allocation. The development of schools will receive a major portion along with other educational facilities such as Qatar Foundation’s Education City project.

Although the current $7.5bn expansion phase of Education City is due to reach completion in late 2014, further major expansions are likely.

Health accounts for 18% of the 2013/14 capital spending budget. This will go towards a number of medical facility expansions, such as Hamad Medical City, health centres and Sidra Medical and Research Centre, a teaching and research hospital connected to Education City.

Looking ahead, government capital spending is likely to remain at a similar level until around 2017, after which there may be a slight tail off.

The current phase of projects has been accelerated in order to be completed ahead of the 2022 World Cup. The bulk of the work on the major railway, road and real estate projects is expected to be completed by 2017.

“Current spending is also likely to continue steady expansion to meet the needs of a growing population. The government is well resourced with minimal debt and is therefore unlikely to face any spending constraints for some time,” QNB said.