By Santhosh V Perumal/Business Reporter

The Qatar Central Bank’s (QCB) move to offer QR4bn of bonds and sukuk is “positive” and will enhance options for domestic financing and reduce reliance on foreign funding, according to Beltone Financial.

“The issuances are seen as part of continued efforts by Qatari authorities to facilitate liquidity management and deepen local financial markets by extending the domestic bond yield curve,” Beltone said in a report.

The QCB recently announced that it will offer QR3bn three-year bonds and QR1bn five-year sukuk on a quarterly basis starting this month.

“Recent efforts to develop local debt markets are positive, and will enhance options for domestic financing and reduce reliance on foreign funding,” it said, adding the authorities have also taken steps to list government bonds in addition to treasury bills on the Qatar Exchange and set up a domestic credit rating agency.

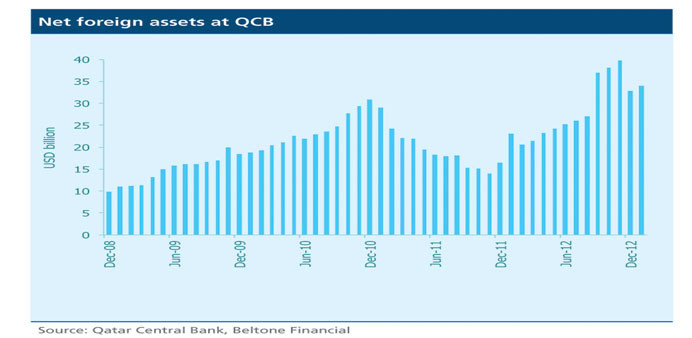

Although the government has more than enough budgetary surpluses thanks to vast liquefied natural gas exports revenues, a secondary debt market will provide government related entities and corporates an alternative funding channel to carry out the infrastructure investment programme, Beltone said. “This is positive in the context of a tight domestic funding situation and large foreign liabilities in the Qatari banking sector,” it said. Beltone also said net foreign assets at the QCB recovered slightly to $34bn in January 2013 from $32.8bn in December 2012.

This was mainly due to recovering QCB balances with foreign banks, while other foreign securities remained unchanged, it said.

As for commercial banks, foreign assets increased for the second consecutive month to $36.8bn in January 2013 from $35.3bn in December 2012.

Interestingly, commercial bank’s foreign liabilities fell by around 4.3% month-on-month (MoM) to $59bn in January 2013, the report said. But foreign liabilities remain substantial at 26.1% of total assets across the banking sector, representing a potential liquidity risk in the case of tighter and/or limited access to external borrowing, Beltone said.

Finding that the domestic loan book remained relatively stagnant at 0.1% MoM in January 2013, Beltone said this was weighed down by the contraction in public sector loans, which fell 0.9% MoM in January 2013 after a 1.3% rise the previous month.

In particular, bank lending to government institutions, which accounts for 62.1% of public sector loans, was down 3.6% MoM in January this year, while, private sector credit growth slowed to 0.9% in January 2013 from 1.6% in December 2012.

This is against the backdrop of declining consumption loans, down 2.2% MoM, representing 26.6% of private sector loans. Bank lending across other segments in the private sector remained positive, with faster growth seen in services (+2.7% MoM) and commerce (+2.3% MoM).

“We continue to see strong demand for bank lending ahead, led mostly by government institutions, with over half of the estimated $21bn project pipeline in 2013 concentrated in infrastructure and construction,” it said.