Oman Telecommunications Co hired banks including Citigroup Inc and Credit Suisse Group AG to raise about $1.5bn from the sale of dollar bonds, according to two people with knowledge of the matter.

The company also mandated HSBC Holdings, Bank ABC, Bank Muscat and Standard Chartered for the sale that could happen as early as this month, said the people, asking not to be identified because the information is private. The company will use the proceeds to repay a bridge loan it raised in October to purchase a stake in Kuwait’s Mobile Telecommunications Co, or Zain, they said.

Omantel didn’t immediately respond to requests for comment.

The phone operator become Zain’s second-largest shareholder in November when it bought a 12.1% stake in Zain after a public auction on Boursa Kuwait. It also bought 9.84% of Zain in August, paying a total of $2.19bn. The company financed the acquisition with a $1.45bn bridge loan and an $800mn loan that matures in 2022.

Chief executive officer Talal al-Mamari said in November that the company plans to raise about $1.4bn from the sale of bonds and sukuk in the first quarter to help repay the loan.

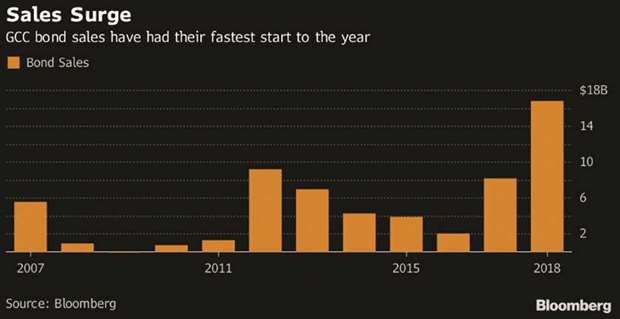

Omantel joins a list of regional issuers seeking funding from debt markets before expected increases in US interest rates push up borrowing costs. In what’s been a record start to a year for debt sales in the Gulf, Emirates, the world’s biggest airline by international traffic, said on Wednesday that it hired banks for an Islamic bond sale. Dar Al Arkan Real Estate Development hired 8 banks to manage the sale of sukuk.

.