Bloomberg

Singapore

The tables have turned when it comes to Singapore’s downtown office rents.

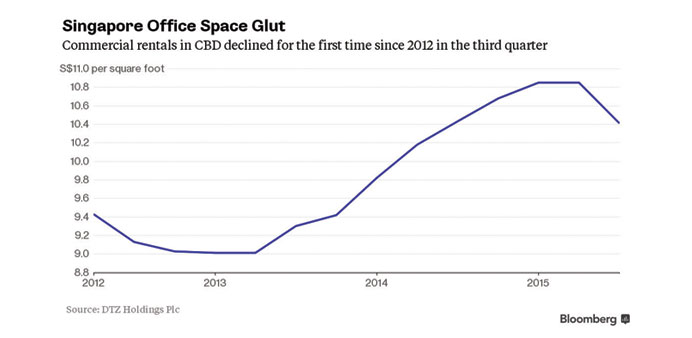

Tenants will now be getting the upper hand at rental negotiations as leasing rates posted their first quarterly drop since 2012, according to DTZ Holdings. With both demand and the city-state’s economy slowing, the pace of decline is set to accelerate.

Rents may fall as much as 7% this year and a further 8% in 2016, said Nai Jia Lee, regional head of research for Southeast Asia at DTZ. Average monthly gross rents in the central business district posted a 4.1% quarter-on-quarter decrease to S$10.40 (US$7.30) per square feet in the three months ended September 30, DTZ said.

Rents and occupancy rates in the prime district may face headwinds in the next few years, following global economic uncertainties and large upcoming supply, Lee said.

“It’s more of a tenant’s market as they have a lot more options now,” Lee said. “The impending supply and lack of a demand pick-up are both going to increase pressure on rents next year. Rents will continue to weaken unless the global economy picks up.” More supply is on the way. About 2.6mn square feet of office space will be added next year in the prime district, the bulk of which will come from the 1.9mn square feet at the Marina One project.

The competition isn’t limited to the main financial district. The completion of Duo Tower and Guoco Tower in 2016 will yield another 1.5mn square feet of space on the fringes of the prime districts, according to DTZ.

Average monthly gross rents in Marina Bay – the newer part of the financial district – fell 5.5% in the quarter to S$13 per square foot, while rents in the older Raffles Place area decreased 3.4% to S$10.45 per square foot, DTZ data showed. Weaker global growth and China’s economic slowdown have contributed to a less optimistic outlook for Singapore, hurting leasing demand, DTZ said. Office occupancy in the central business district also fell almost 1 percentage point to 95% in the quarter, the data showed.

Still, declining rents for both the office and home market may restore Singapore’s edge as an attractive place to live and work, according to Savills. The city-state’s living and working costs posted the biggest decline across 12 global cities in a study by the property brokerage.

The average cost to accommodate employees dropped by 17% for Singapore between 2008 and the first-half of this year, according to the Savills Live/Work Index released on Monday, which measures the combined cost of residential and office rental per person per year. Tokyo and Dubai also posted declines in their live/work costs, Savills data showed.

“This reflects high growth and relatively high levels of rents seen in these cities prior to 2008 and cheaper rents will help correct affordability and may be seen as a competitive advantage on the global stage,” Yolande Barnes, director, Savills world research said.

For office tenants, that means better bargains ahead.

“Lots of companies are shelving their expansion plans so landlords have become more flexible on the lease terms too,” Lee at DTZ said. “Older buildings will face a greater challenge in retaining their tenants.”