Jordanian economy is recovering from the crisis in 2012, with support from the International Monetary Fund and Gulf Co-operation Council countries, QNB has said in a report. International reserves of the Central Bank of Jordan (CBJ) more than doubled in 2013 and economic activity is now picking up.

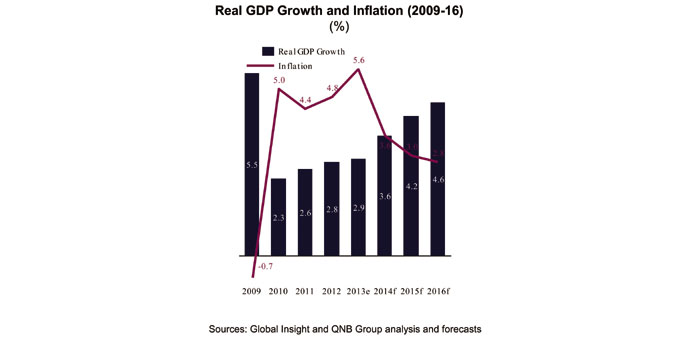

On this basis, QNB forecasts real GDP growth to accelerate from an estimated 2.9% in 2013 to 3.6% in 2014 and to average 4.4% during 2015-16, driven by private sector led growth in the construction sector, lower energy costs, a recovery in tourism, a normalisation of mining exports as well as growth in other services.

The large influx of refugees from the Syrian conflict continues to pose a significant economic challenge. Jordan is the second largest recipient of Syrian refugees in the region according to the UN High Commissioner for Refugees, who currently total around 600,000 (9.1% of the total Jordanian population). Domestically, the labour and housing markets are particularly affected, with the refugees putting downward pressure on wages and upward pressure on rents (most live in urban areas and not in camps). With over 44% of the refugees aged 18-59, the domestic labour force is expanding rapidly leading to pressures on the market.

In response to the resulting foreign exchange market pressures from the Syrian conflict, the CBJ was forced to raise policy rates repeatedly in 2012. This tightening of monetary policy, combined with an improvement in external financial support (in the form of loans and grants), has helped to restore the confidence in the Jordanian dinar and led to a doubling of foreign exchange reserves in 2013.

Going forward, these trends are likely to continue in the near term as higher appetite for dinar-denominated assets grows and overall investor sentiment towards the Jordanian economy improves further, thus spurring higher growth, QNB said.

The current account deficit has narrowed and reserves are now at comfortable levels. Indeed, lower energy imports and grants have reduced the current account deficit significantly in 2013. Going forward, the current account deficit is expected to continue narrowing due to higher export growth.

Key exports, such as phosphates and potash, are expected to accelerate on the back of strengthening global demand. The rate of import growth should moderate in the near term, helped by stabilisation in global energy prices. Tourism receipts, particularly from GCC visitors, are projected to rise on the assumption that the geopolitical situation improves.

Looking ahead, prospects for the Jordanian economy look better with real GDP growth expected to recover gradually in 2014-16, mainly driven by private sector growth in the construction sector, lower energy costs and a recovery in tourism. Growth will, however, continue to remain below its long-term potential as investment suffers from the Syrian conflict and the government fiscal adjustment. The main downside risks stemming from a worsening in the geopolitical situation, higher crude oil prices, and potential delays in implementing structural reforms.

Furthermore, a complex bureaucracy and the high cost of doing business in Jordan are major impediments to higher FDI, particularly from GCC countries, QNB said.