By Pratap John/Chief Business Reporter

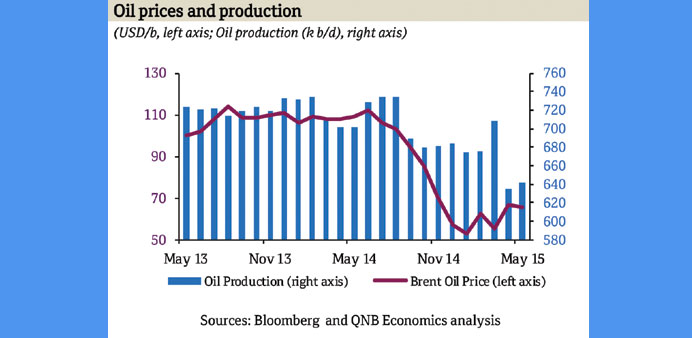

Qatar’s crude oil production is expected to rebound and average 709,000 bpd in 2015, a new report has shown.

According to QNB, Qatar’s crude oil production rose to 642,000 bpd in May compared with 635,000 bpd in April.

Over the same period, Brent crude oil price stabilised at $65.6 at end-May compared with $66.8 in April.

In its latest Qatar Monthly Monitor, QNB said Qatar’s international reserves rose to $41.8bn in May compared with $41bn in April.

In months of prospective import cover, international reserves were stable at 7.4 months of imports.

“We expect the accumulation of international reserves to continue, reaching $46bn, or eight months of import cover at end-2015,” QNB said.

The overall balance of payments recorded a small deficit in Q4, 2014 of $0.5bn, leading to a decrease in international reserves.

Qatar’s current account surplus narrowed ($10.5bn in Q4, 2014) on lower hydrocarbon exports; the capital and financial account recorded a deficit of $9.5bn in Q4, 2014.

“We expect the current account surplus to shrink to $3.7bn in 2015 (4.6% of GDP) due to lower oil prices, before recovering slightly in 2016-17 in line with the recovery in oil prices,” QNB said.

The report shows Qatar’s foreign merchandise trade surplus narrowed to $4.1bn in April 2015, down from $8.5bn a year earlier.

The decline was mostly due to the fall in petroleum exports, which decreased by 41.9% year-on-year on lower oil prices; imports rose by 19.5% over the same period on strong domestic demand.

“We expect the merchandise trade surplus to shrink to $49.9bn in 2015 from $100.6bn in 2014 on lower oil prices,” QNB said.

Bank deposits’ year-on-year growth accelerated to 7.7% in May from 6.1% in April.

Public sector deposits contracted by 4.3% year-on-year in May 2015; private sector deposits grew by 6.6%; non-resident deposits nearly doubled, growing by 99.5%.

“We expect double-digit deposit growth of 11.3% in 2015 reflecting strong population growth,” QNB said.

The banking sector’s overall loan book grew by 11.6% year-on-year in May 2015 down from 12.1% in April.

Public sector lending contracted by 9.2% year-on-year while lending to the private and foreign sectors grew by 22.5% and 42% respectively.

“We forecast bank lending to grow by 9% in 2015, increasingly driven by project lending and the expanding population; as a result the loan-to-deposit ratio is expected to decline gradually to reach 106.5% in 2015,” QNB said.

Qatari banking assets growth accelerated to 7.9% in May from 6.9% in April, driven by strong lending growth.

Foreign assets grew by 8.3% year-on-year, driven by the expansion in credit; while domestic assets grew by 8.2%, driven mainly by the growth in domestic credit (8.8%)

“We expect bank assets to rise by 10% in 2015, increasingly driven by project lending,” QNB’s monthly monitor said.