By Pratap John

Despite the US shale gas revolution, Qatar is unlikely to lose its leading role in the global energy market for many more years due to strong Asian demand, a new report has shown.

US shale gas is now commercially viable and has virtually eliminated the need for the world’s largest economy to import liquefied natural gas (LNG), including from Qatar, QNB said in a report yesterday.

“Fracking techniques — namely the process of forcing water, chemicals and sand at high pressure into shale rock deposits to extract high volumes of gas — have been refined only over the last decade to make US shale gas commercially viable. The so-called US shale gas revolution, is not proving to be a game changer for Qatar,” QNB said.

The drop in US demand, however, has been replaced by strong demand from Asia, particularly from Japan after the Fukushima nuclear accident in March 2011.

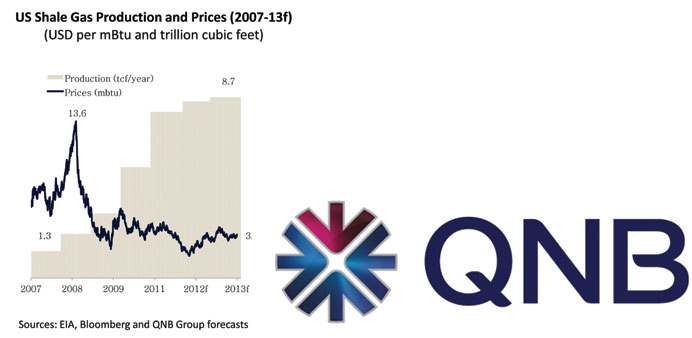

US shale gas production is estimated to have risen almost seven fold during 2007-13, reaching a forecast 8.7tn cubic feet in 2013. This has pushed down US gas prices at the Henry Hub terminal from a peak of $13.6 per million of British thermal units in 2008 to $3.8 in November this year.

The US Energy Information Agency (EIA) expects shale gas to account for nearly half of total US gas production over the next two decades, compared with just over one third today.

And according to Citigroup, the shale gas boom is likely to lead the US to energy independence by 2020, when it will no longer need to import gas or oil to meet its energy needs.

While the US is becoming energy independent, Asia continues to have ever-growing energy needs. Asian LNG demand has grown rapidly in recent years from both traditional buyers and new ones. This trend is likely to continue in the future, QNB said.

Reflecting these changes in the global energy market, Qatar has redirected its LNG exports over the last three years from the US to Asia. China started importing LNG from Qatar in August 2013 and is now finalising its first floating LNG terminal to start receiving gas for Tianjin city this month.

Japan has switched from nuclear to gas-fuelled power stations following the Fukushima disaster, which has more than made up for the loss of US LNG imports. In addition, other economies in Asia are increasing their imports of LNG from Qatar, including India, Malaysia and Thailand. Demand from Asia is likely to continue to remain strong as its economies expand rapidly over the medium term.

The US shale gas revolution is also unlikely to spread to other parts of the world. While Asia has the largest proven reserve of shale gas in the world (19% of the world’s total), technical issues such as the depth of gas deposits, proximity to urban areas and the shortfall of technological skills, make exploitation costly and will prevent a development of the industry similar to that of the US in the near term.

As a result, Asia will likely continue to remain Qatar’s largest LNG importer over the medium term. In Australia, early attempts to develop the shale gas industry have turned out to be very costly and have not yet produced significant output.

In Europe, shale gas is for the most part not commercially viable or allowed for ecological concerns. In particular, Hungary and Poland are finding it increasingly difficult to extract shale gas profitably.

In addition, concerns about the polluting water discharge from fracking techniques have pushed Bulgaria and France to ban shale gas extraction outright.

Overall, the US shale gas revolution has resulted in a redirection of Qatar’s LNG exports to Asia.

Going forward, strong Asian demand and the limited impact of the US shale gas revolution on global energy markets are projected to result in strong demand for Qatar’s LNG exports.

“Qatar therefore is likely to maintain its leading role as the largest LNG exporter in the world for years to come,” QNB said.