Oil

Oil prices dropped about 2% on Friday, weighed down by falling US stock markets, while weak economic data from China pointed to lower fuel demand in the world’s biggest oil importer. Brent crude fell $1.17 to settle at $60.28 a barrel, a 1.90% loss. US West Texas Intermediate (WTI) crude futures lost $1.38 to settle at $51.20 a barrel, a 2.62% loss.

Global benchmark Brent posted a weekly loss of almost 2.3%, while WTI declined nearly 2.7% for the week.

US equity markets broadly fell during the week as China’s November retail sales grew at their weakest pace since 2003 and industrial output rose the least in nearly three years. The report added to nerves about US-China trade relations. Chinese oil refinery throughput in November fell from October, suggesting an easing in oil demand, though runs were 2.9% above year-ago levels.

Concerned by mounting oversupply, the Organisation of the Petroleum Exporting Countries and other oil producers, including Russia, have agreed to reduce output by 1.2mn barrels per day (bpd). The International Energy Agency said on Thursday it expected a deficit in oil supply by the second quarter of next year, provided Opec members and other key producers stuck closely to this deal.

Baker Hughes energy services reported that US energy firms cut oil rigs for a second week in a row last week, bringing the total count down to 873, the lowest since mid-October. The data is seen as an indicator of future production. The IEA kept its 2019 forecast for global oil demand growth at 1.4mn bpd, unchanged from its projection last month, and said it expected growth of 1.3mn bpd this year. Barclays said on Friday it expects oil prices to rebound in the first half of 2019 on falling inventories, Saudi Arabia’s export cuts and an end to the Iran sanction waivers.

Gas

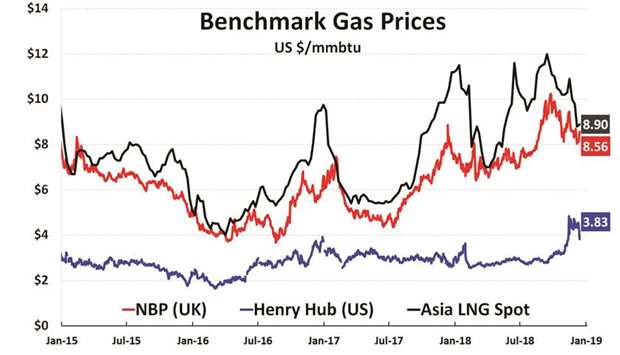

Asian spot prices for liquefied natural gas (LNG) snapped a three-week losing streak to end higher last week, with the onset of winter expected to boost demand for natural gas for heating. However, gains were limited amid forecasts of warmer-than-usual temperatures for most of next week in Tokyo, Beijing and Seoul – the top demand centres for natural gas in Asia, and as more spot supply entered the market from the US and Russia.

Spot prices for January delivery edged up about 10 cents to around $8.90 permn British thermal units (mmBtu), with cargoes trading from as low as $8.50 per mmBtu to as high as $9.10 per mmBtu, several industry sources said.

China, the world’s No 2 LNG importer, has ramped up both domestic gas production and imports as the government switches more households to gas heating. It has switched another 3.29mn households to gas heating this winter, more than it added last year.

However, analysts said the increase would not necessarily boost overall consumption in the country.

Taiwan’s CPC entered the spot market to seek a cargo for delivery in January, while South Korea’s state-run Korea Gas is looking for long-term supply starting from 2025. On the supply side, Cheniere Energy loaded the commissioning cargo of LNG from its Corpus Christi liquefaction facility in Texas. Russia’s Yamal LNG has started up train 3 at its plant, 12 months ahead of schedule, with the plant reaching full capacity of 16.5mn tonnes a year.

n This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development.

Graph 23