As large emerging market (EM) economies catch up and continue to grow faster than major advanced economies, the G20 dynamics evolve, making it an ever more important arrangement for global economic governance, QNB has said in an economic commentary.

The recent detente in bilateral trade between the US and China, agreed last week during the G20 Summit in Buenos Aires, is just the latest expression of both the new dynamics and overall importance of the forum.

“The G20 has indeed gone a long way from its origins in the late 1990s and is set to become even more central as global economic convergence takes place. Our analysis focuses on the underlying economic factors behind the G20 growing influence,” QNB said.

The G20 is an international forum for the governments and central bank governors of some of the largest economies in the world, deemed of systemic significance for the international financial system.

Membership includes 19 countries and one bloc, the European Union, represented by the European Commission and the European Central Bank. Member countries are comprised of the traditional G7 countries (Canada, France, Germany, Italy, Japan, the UK, and the US), Brics countries (Brazil, Russia, India, China, and South Africa), MIST countries (Mexico, Indonesia, South Korea, and Turkey), Argentina, Australia as well as Saudi Arabia.

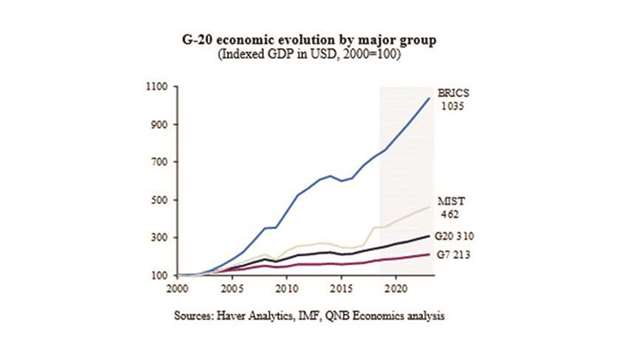

Taken together, the G20 makes up more than 90% of the world economy. While this number has been stable since the official creation of the group in 1999, the economic clout of different countries within the group has changed dramatically. Indeed, the strength of the G-7 has dwindled, while large EM economies, led by the Brics and MIST countries, have increased substantially.

Curiously, the G20 was initially conceived by the G7 countries to tackle international financial stability issues associated with the spillover of EM balance of payment and debt crisis in the late 1990s. Back when the G20 was created, EM economies were still seen as the most important sources of international financial crisis. However, perceptions changed significantly after the Great Financial Crisis (GFC) of 2007-09, when the G20 was chosen as the preferred forum for a co-ordinated response to the crisis. The status of the G20 has then changed and activities started to include a summit of heads of state or government.

The 2009 G20 London Summit was a watershed moment for global economic co-ordination, as member states pledged to mobilise $1.1tn to support trade finance and international financial organisations.

Since then, the G20 evolved to become the premier forum for discussing, planning and monitoring the global economy. Importantly, EM members of the G20 started to be seen as equal partners or part of the solution to the crisis originated in the advanced economies rather than sources of financial problems.

The change in the status of the EM economies within the G20 was and still is mostly associated with their economic performance and growing influence in both global activity and finance. While the G7 countries represented 73% of the nominal GDP of the G20 (in dollar terms) when the forum was created, this number has shrunk to 60% during the peak of the GFC and now hovers around 50%.

In contrast, EM economies increased their GDP share within the G20 from the initial 15% to 25% in the peak of the GFC to the current 34%. Large Brics and MIST countries spearheaded the way.

China, India, Indonesia, Turkey, South Korea and Russia were the G20 growth champions over this century. Under their leadership, the Brics and MIST were able to expand respectively 8.6 and 2.4 times faster in nominal terms (dollar) than G7 countries.

The Brics currently represents around 27% of the G20 economies, while the MIST represents nearly 5%.

Over the next five years, the International Monetary Fund estimates that the Brics and MIST are going to continue to grow faster than the G7 economies. From 2019 to 2023, the Brics and MIST are expected to grow respectively 2.2 and 1.8 times faster than the G7 economies, representing 31% and 6% of the G20 USD nominal GDP, respectively.

In short, QNB noted global economic convergence is expected to continue and the importance of the G20 as a forum for governance is set to increase accordingly, as key EM economies become systemically significant for financial stability and global growth.

G20