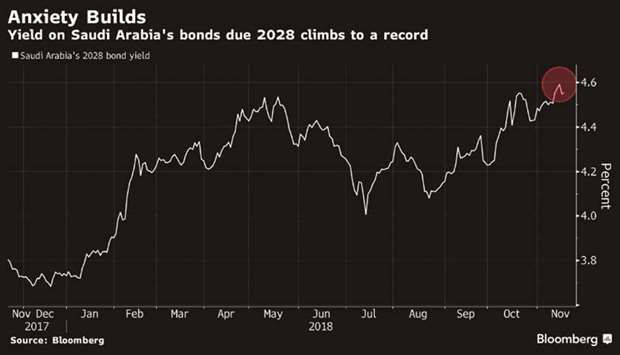

As if the fallout over the killing of columnist Jamal Khashoggi wasn’t enough, oil’s decline has helped make Saudi bonds the worst performers among Gulf peers in the second half of this year. But all this panic has created buying opportunities.

“There are times when risks get overpriced,” said New York-based Shamaila Khan, director of developing-nation debt at AllianceBernstein. “We like to take advantage of that when it happens.”

The nation’s bonds have been roiled by the international outrage over the murder of Khashoggi at the Saudi consulate in Turkey. Meanwhile, the price of oil, the kingdom’s main source of income, plummeted into a bear market as the US granted surprise waivers for sanctioned Iranian crude, spurring the yield on Saudi Arabia’s $5bn bonds due 2028 to a record last week.

The kingdom’s five-year credit default swaps jumped 41% this quarter, the most among 40 contracts tracked by Bloomberg globally, to 96 basis points on Monday, according to CMA prices.

While sanctions on Saudi Arabia for now are “too little” to affect the economy, any escalation would probably cause a further sell-off in its bonds, said Zeina Rizk, a director of fixed-income asset management at Arqaam Capital Ltd in Dubai. The Trump administration last Thursday announced sanctions against 17 Saudi officials implicated in Khashoggi’s killing. Some US lawmakers have demanded tougher action against the kingdom.

“At this stage the way it can unfold is very uncertain,” Rizk said in a Bloomberg Television interview. The buying opportunity in the kingdom’s bonds would come once the year-end volatility subsides, she said.

Oman and Bahrain, which have the weakest finances in the region, have also seen their bonds decline with crude. The yield on Oman’s 2028 bonds have risen almost every day this month to 6.6% yesterday, near the highest since the notes were issued this year, and the rate on similar maturity Bahraini securities climbed for a seventh day yesterday.

For Brett Rowley, the Los Angeles-based managing director for emerging markets at TCW Group Inc, the short-term outlook for debt in the six-nation Gulf Cooperation Council is being clouded by oil, and the sell-off could provide an opportunity to gain “exposure to the energy producers at more attractive levels,” he said. “A 2014-style collapse is not our base-case scenario.”

The economies of GCC members are set to grow 2.4% this year and 3% in 2019, after contracting in 2017, the International Monetary Fund said last week.

Most of the countries in the region are “fairly strong credits” and will be able to withstand the recent drop in oil, said Khan at AllianceBernstein.

Graph 3