Oil

Benchmark crude oil futures continued declining for the third week in a row by losing more than 2% last week. Prices were pressured by multiple factors, including a sharp sell-off in global equity markets, concerns about demand outlook and Saudi Arabia pledge to balance the market. The weakness in equity markets is adding to the concerns over the demand outlook, although some analysts are still eager to witness an actual slowdown in demand. However, the price drop was offset partially by the support from upcoming US sanctions on Iran that will take effect early next week, a sharp fall in US gasoline and distillate stocks and a rebound in equities by the end of last week.

The volatility in prices has proved strong last week and there are likely to be more surprises going forward. The aftermath of the 4th November deadline over US sanctions on Iran is believed by analysts to more likely to end up supporting the prices, whereas the oil market being assessed as oversupplied in the fourth quarter will keep the prices in check. The reaction of Saudi Arabia will be key in whether there is a need to compensate for any supply loss or intervene in the market to reduce the rising inventories.

Gas

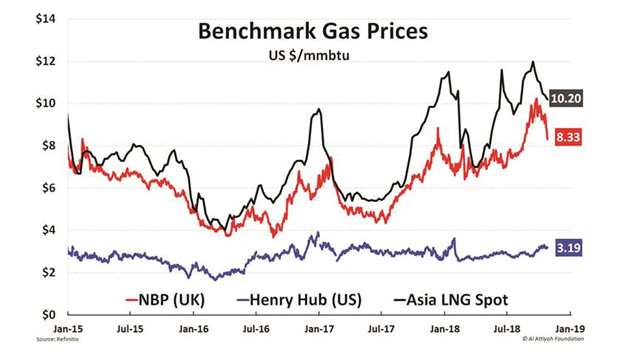

Asian spot LNG prices fell again last week, losing about 16% since mid-September. LNG prices were squeezed by a lower Asian demand and an increased supply, with bids and offers being far apart. The weak Asian LNG demand is illustrated by the situation in Japan, where the restart of some nuclear reactors has diminished the LNG appetite, along with a warmer weather outlook.

Facts Global Energy Consulting expects Japan to have about 9GW of nuclear capacity running this winter compared to only 3.5GW last winter. On the supply front, six LNG tankers are floating in Singapore and Malaysian waters, failing to find customers. As LNG freight rates are soaring, more LNG is finding home in northwest Europe.

In the US, Henry Hub natural gas futures fell last week by 2% on record gas production and forecasts of warmer weather prompting a lower heating demand. Last Monday, daily US gas output rose to an all-time high of 87.2 bcfd. Meanwhile, UK gas futures recorded a sharp decline of more than 10% last week. Prices fell mostly due to more available LNG supply and to a high wind power generation during at least two days. Northwest Europe is expected to receive 2.6mn tonnes of LNG, by the end of October — the highest monthly figure since 2013.

This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development.

Weekly