While oil prices are reaching a four-year high, continued US output growth and the new Russia-Saudi Arabia oil deal are posing a question to whether the market is entering a new era.

QNB analysis delves into the demand and supply factors of the oil market, concluding with an outlook for next year.

“A modest excess demand should continue over the next months before additional supply capacity is expected to come on-stream. The market is expected to reach a broad balance by the end of this year,” QNB said.

So far in 2018, Brent prices have averaged $73/b, up from $55/b in 2017 and $44/b in 2016. Prices are up 27% year-to-date, fluctuating around the $85/b mark in early October.

A number of factors have been pushing oil prices more than expected in 2018 from a demand and supply side perspective.

On the demand side, global GDP is on course for its strongest growth since 2011, and spurs robust petroleum consumption, QNB noted.

According to the US Department of Energy (DoE), global demand for crude oil is expected to average 100mn barrels per day in 2018.

The outlook for demand growth in 2019 is set to stand on a firm footing.

Activity in the US is expected to soften a touch, but this should be offset by sturdy growth in global manufacturing and in most emerging market economies.

Overall, the DoE is expecting demand to average 102mn bpd in 2019.

On the supply side, there are two different key factors playing out in 2018.

First, the US oil output boom associated with the so-called “shale revolution” is set for a temporary slowdown due to infrastructure bottlenecks.

While a total of 1mn b/d has been added to US output so far this year, limited pipeline capacity in the key shale oil producing region of the Permian Basin in west Texas threatens to restrain supply growth to lower rates than previously anticipated.

A jump in ‘drilled but uncompleted wells’ in the Permian (a key gauge of delayed output for shale producers) points to slowing supply growth in the short-term as producers delay output until takeaway capacity is boosted.

Second, major stakeholders of the Opec+ agreement, including GCC exporters and Russia, have been compliant to the output cuts allocated to them over 2016 and 2017.

Additionally, idiosyncratic supply disruptions are affecting important producers, including Opec members such as Venezuela and Iran. A deepening economic crisis has pushed Venezuela’s production down in 2018.

The US announcement to re-introduce sanctions on Iran is already affecting the Iranian oil industry and Bloomberg estimates that production plummeted between May and September 2018.

Such developments are requiring an extra effort from core Opec+ countries to compensate the losses and balance the markets. Russia and Saudi Arabia emphasised their willingness to balance this fallout in production.

Both countries, ahead of the recent meeting in Algiers, agreed to raise their production levels further with Saudi Arabia’s output expected to reach a record high of 11mn b/d by end-2018.

“The outlook for 2019 points to an increase in supply from the 100m b/d average for 2018 to 102mn bpd. The Opec+ agreement is set to expire at the end of 2018 and free up more supply,” QNB said. In addition, the US shale output should re-accelerate with the increase in pipeline capacity from the Permian Basin by mid-2019. US crude exports, which are currently being capped around 2mn bpd by infrastructure constraints, could reach 3mn bpd by end of 2019.

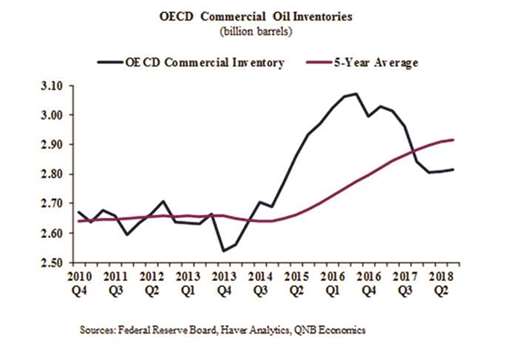

In summary, QNB said “continued excess demand” has been drawing down OECD commercial inventories since Q3, 2016, from 3.1bn to the current 2.8bn barrels level.

This is very close to the 5-year average benchmark, the declared target for the Opec cut agreement.

“In short, the oil market in our view finds itself in broad balance. Therefore, we expect an average annual oil price of around $72/b. For 2019, forward prices indicate an average of $82/b and consensus forecasts are pointing to $73/b.

“Hence, the outlook indicates that the moderate over-supply should push prices down towards our forecast average of $69/b for 2019,” QNB said.