When the state-owned oil company of the UAE decided to sell a stake in its fuel-retailing unit, it had a lofty valuation target.

According to people familiar with the matter, the Abu Dhabi National Oil Co, or Adnoc, was hoping the initial public offering would value the business at as much as $14bn. Nearly half a year later, Adnoc is settling for far less: $8.5bn.

The company hasn’t commented publicly on the valuation.

That drop will resonate through the Middle East, where governments are counting on their oil giants to raise cash. The Adnoc fuel-distribution IPO is the first of several expected in the region – most notably that of Saudi state-owned oil giant Aramco – a trend that will partly reverse the nationalisation of the Middle East’s energy industry that started in 1950.

Mohammed bin Salman, the young Saudi crown prince, has said Aramco is worth at least $2tn and potentially more. If achieved, the sale of 5% of the company would raise $100bn, dwarfing the $25bn raised by Chinese Internet retailer Alibaba Group Holding Ltd in 2014.

The Adnoc deal will provide the Saudis with pause for thought.

After privately talking about a valuation as high as $14bn, Adnoc initially set a guidance for its fuel-distribution IPO of as much as 2.95 dirhams per share, implying a top valuation just above $10bn.

Weeks later, it lowered the maximum price of its guidance range to 2.65 dirhams – valuing the whole company at $9bn – and on Friday it finally settled for 2.5 dirhams, or $8.5bn, according to terms seen by Bloomberg News. The company, which mooted selling as much as 20% of the unit, ended up selling just 10%.

To be sure, the Adnoc IPO is a very different animal from the Saudi Aramco IPO: the unit that Abu Dhabi is selling operates filling stations in the UAE, at the far end of the supply chain from the prized oil fields that generate the region’s extraordinary wealth. Still, it shows that governments and investors hold different views about the value of the assets and highlights that rising political risk in the region could deter some investors.

While there’s a lot of guesswork involved in sizing up a company like Aramco that’s never divulged financial statements, private sector analysts have put much lower valuations for Aramco, with Sanford C Bernstein & Co saying it could be $1tn to $1.5tn. Tudor Pickering Holt & Co, a Houston boutique bank focusing on energy, put the valuation at $1.1tn.

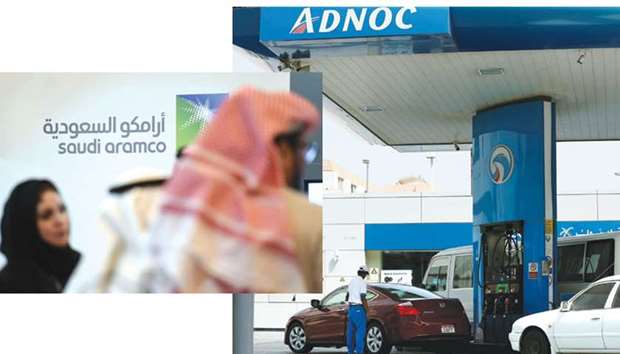

Saudi and foreign investors stand in front of the logo of state oil firm Aramco during a business event in the capital Riyadh. Right: A worker fills a car with fuel at an Adnoc petrol station in Abu Dhabi. Adnoc was earlier hoping the initial public offering would value its fuel retailing business at as much as $14bn. Nearly half a year later, Adnoc is settling for far less: $8.5bn.