The economic slowdown in the GCC region has adversely impacted migrant worker flows from the South Asia region in 2016, a World Bank report has shown.

For Pakistan, registered migrant workers in Saudi Arabia dropped from 522,750 in 2015 to 462,598 in 2016; those in the United Arab Emirates fell from 326,986 in 2015 to 295,647 in 2016.

With only 89,624 registered for Saudi Arabia up to July 2017, a steep fall in Pakistani migration to that country is anticipated, according to the Global Knowledge Partnership on Migration and Development KNOMAD, which has been established by the World Bank.

The number of Indian workers emigrating to Saudi Arabia dropped from 306,000 in 2015 to 162,000 in 2016; those going to the United Arab Emirates decreased from 225,000 in 2015 to 159,000 in 2016, KNOMAD report showed.

The total Indian worker outflows fell from 781,000 in 2015 to 506,000 in 2016.

Bangladesh bucked the trend somewhat, given earlier Saudi plans for recruitment of 400,000 workers (half of them female) from Bangladesh.

Its migrants to Saudi Arabia jumped from 58,270 in 2015 to 143,913 in 2016, but those to the United Arab Emirates dropped from 25,271 to 8,131.

The report noted that stricter immigration policies in many remittance-source countries — including labour market “nationalisation” policies in the Gulf Cooperation Council (GCC) countries — are slowing down the hiring of foreign workers and dampening remittance flows.

Fiscal tightening in the GCC due to low oil prices and policies discouraging the recruitment of foreign workers have dampened outward remittance flows, it said.

Remittances from GCC countries will be partly impacted this year by lower growth due to oil production cuts and fiscal consolidation, which still weighs on activity in the non-oil sector. Remittances from Saudi Arabia declined by 8% until July 2017, compared to the same period in 2016, KNOMAD said.

A new fee on expat dependents in Saudi Arabia introduced this year and the 2018 value added tax (VAT) introduction are likely to further reduce remittances in the future. Nationalisation programmes in Saudi Arabia and the United Arab Emirates, favouring employment of nationals over foreign workers, are increasingly gaining traction.

However, remittances from Kuwait, where a significant number of Egyptians work, increased by 7.4% year-on-year in the first quarter of 2017. Only a small number of migrants from the Mena region work in Qatar and are thus likely to be affected by the blockade on Qatar.

Remittance growth in the South Asia region is expected to remain weak with a modest 1.1% growth in 2017 due to the continuing impact of lower oil prices and “nationalisation” polices leading to constrained labour market conditions in the GCC.

This represents a slight improvement over the 6.1% remittance fall seen in 2016. Oil price declines started impacting the region from 2015 onward and intensified in 2016.

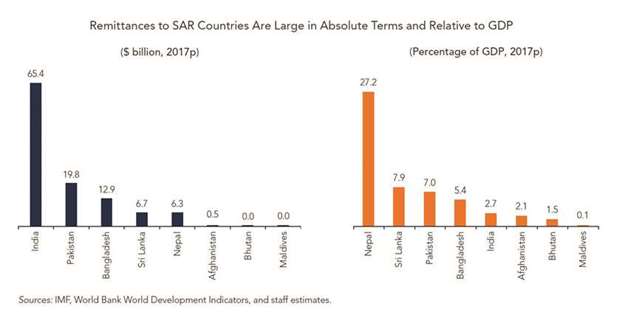

India witnessed an 8.9% remittance decline in 2016. Its remittance growth is expected to remain moderate at 4.2% in 2017 amounting to about $65bn.

Pakistan is projected to have 0.2% remittances growth in 2017 compared to 2.4% growth in 2016.

For Bangladesh, remittances would decline by 5.2% in 2017 following a 11.4% decline in 2016. For Nepal, a projected decline of 4% this year would follow a 1.8% decline in 2016. For Sri Lanka, the 3.7% remittance growth in 2016 is projected to deteriorate to an 8.1% fall in 2017. Remittance growth in the region is projected to remain moderate due to cyclical and structural factors.

.